Running a business in Dubai is an exciting opportunity, but it also comes with its own set of challenges. One of the most important aspects of managing a successful business is keeping your finances in check. This is where accounting services in Dubai come into play. In this article, we will explore why accounting services are crucial for businesses in Dubai and how they can help you stay on top of your financial game.

Why Accounting Services Are Essential in Dubai

Dubai is known for its thriving business environment, with companies from all over the world setting up shop in this vibrant city. However, managing finances in Dubai can be complex due to the unique legal and regulatory framework. The government of Dubai has implemented various regulations that businesses must adhere to, including value-added tax (VAT), corporate tax, and more. Failing to comply with these regulations can lead to severe penalties and legal issues.

This is where professional accounting services in Dubai become essential. They ensure that your business complies with all the relevant laws and regulations. By outsourcing your accounting needs, you can focus on growing your business while experts handle the financial side of things.

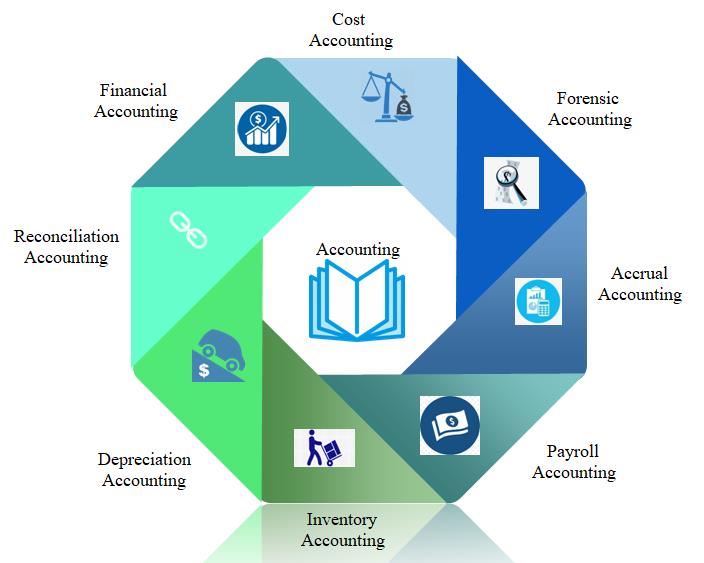

What Do Accounting Services in Dubai Include?

When you hire a firm for accounting services in Dubai, you can expect a wide range of services tailored to meet your specific needs. Here are some of the key services offered by accounting firms in Dubai:

- Bookkeeping: This is the foundation of any accounting service. Accurate bookkeeping ensures that all your financial transactions are recorded correctly. This includes tracking income, expenses, and other financial activities.

- VAT Compliance: VAT is a significant aspect of doing business in Dubai. Accounting firms help you stay compliant with VAT regulations by preparing and filing VAT returns on time. They also provide guidance on VAT-related matters to ensure that your business does not face any penalties.

- Financial Reporting: Regular financial reporting is crucial for understanding the financial health of your business. Accounting services in Dubai include preparing financial statements such as balance sheets, income statements, and cash flow statements. These reports provide valuable insights into your business's performance.

- Payroll Management: Managing payroll can be time-consuming and complicated, especially with the various regulations governing employee salaries and benefits in Dubai. Accounting firms can handle payroll processing, ensuring that your employees are paid accurately and on time.

- Audit Support: If your business is subject to an audit, accounting firms can provide the necessary support. They help prepare all the required documents and ensure that your financial records are in order. This makes the audit process smoother and less stressful.

- Corporate Tax Compliance: With the introduction of corporate tax in Dubai, it has become even more important for businesses to stay compliant. Accounting firms assist in calculating, preparing, and filing corporate tax returns, ensuring that your business meets all its tax obligations.

Benefits of Hiring Accounting Services in Dubai

Now that we’ve covered what accounting services entail, let’s look at the benefits of outsourcing these services for your business in Dubai:

- Time-Saving: Managing your finances in-house can be time-consuming, especially if you lack the necessary expertise. By outsourcing your accounting needs, you free up valuable time that can be better spent on core business activities.

- Expertise and Accuracy: Professional accounting firms have a team of experts who are well-versed in Dubai's financial regulations. This ensures that your financial records are accurate and compliant with local laws.

- Cost-Effective: Hiring an in-house accounting team can be expensive, especially for small and medium-sized businesses. Outsourcing accounting services is often more cost-effective as you only pay for the services you need.

- Peace of Mind: Knowing that your finances are being handled by professionals gives you peace of mind. You can focus on growing your business without worrying about financial compliance and record-keeping.

- Scalability: As your business grows, so do your financial needs. Accounting services in Dubai can be easily scaled to match the growth of your business. Whether you need more complex financial reporting or additional tax services, accounting firms can adapt to your changing requirements.

Choosing the Right Accounting Services in Dubai

With so many options available, choosing the right accounting services in Dubai can be a daunting task. Here are some tips to help you make the right choice:

- Experience and Reputation: Look for an accounting firm with a proven track record and good reputation in Dubai. A firm with experience in your industry is an added advantage as they will be familiar with the specific financial challenges you may face.

- Range of Services: Ensure that the firm offers a comprehensive range of services that meet your business needs. This will save you the hassle of dealing with multiple service providers.

- Technology and Innovation: In today’s digital age, it’s important to choose a firm that uses the latest accounting software and technology. This ensures accuracy and efficiency in managing your financial records.

- Client Support: Good client support is crucial. Choose a firm that is responsive and provides personalized services. You should feel comfortable discussing your financial matters with them.

Conclusion

In conclusion, accounting services in Dubai are essential for any business looking to thrive in this competitive market. From ensuring compliance with local regulations to providing valuable financial insights, professional accounting services can make a significant difference to your business. By outsourcing your accounting needs, you can focus on what you do best—growing your business—while leaving the financial complexities to the experts.