The insurance market in Namibia is a vital component of the country's financial sector, playing a crucial role in mitigating risks, protecting assets, and fostering economic stability. With a diverse range of insurance products and services, the market caters to the needs of individuals, businesses, and institutions. This article provides an overview of the Namibia insurance market, examining its structure, key players, regulatory environment, challenges, and growth prospects.

Structure of the Namibia Insurance Market

Namibia's insurance market is composed of both life and non-life (general) insurance segments, offering a wide array of products to meet the varying needs of the population. These include life insurance, health insurance, motor vehicle insurance, property insurance, marine and aviation insurance, and more specialized policies such as agricultural insurance.

- Life Insurance: This segment primarily offers products that provide financial protection in the event of death, disability, or retirement. Life insurance policies are popular among individuals seeking long-term financial security and estate planning solutions.

- Non-Life Insurance: Non-life insurance, also known as general insurance, includes products that cover property damage, theft, liability, and other risks. Motor vehicle insurance is one of the most common types of non-life insurance in Namibia, driven by the country's growing automotive sector.

Key Players in the Market

The Namibian insurance market is characterized by the presence of several local and international insurance companies. Some of the prominent players include:

- Old Mutual Namibia: A major player in the life insurance sector, offering a range of life and investment products.

- Sanlam Namibia: Another significant entity in both life and general insurance markets, Sanlam provides a variety of financial services, including insurance, investment, and wealth management.

- Momentum Metropolitan Namibia: Known for its comprehensive insurance solutions in both life and non-life segments.

- Hollard Insurance: A key player in the non-life insurance market, offering diverse products such as motor, home, and business insurance.

- Santam Namibia: Specializing in short-term insurance, Santam provides coverage for personal and commercial lines, with a focus on risk management.

Regulatory Environment

The Namibia Financial Institutions Supervisory Authority (NAMFISA) is the primary regulatory body overseeing the insurance industry in Namibia. NAMFISA's role includes licensing insurance companies, monitoring their activities to ensure compliance with regulatory standards, and protecting the interests of policyholders. The regulatory framework is designed to ensure the stability and integrity of the insurance market while promoting fair competition and consumer protection.

Challenges Facing the Market

Despite its growth potential, the Namibian insurance market faces several challenges:

- Low Insurance Penetration: Insurance penetration remains relatively low in Namibia compared to more developed markets. A significant portion of the population is uninsured, primarily due to limited awareness of insurance benefits and affordability issues.

- Economic Conditions: Namibia's economy has faced challenges in recent years, including slow growth, high unemployment rates, and inflation. These economic factors can impact the affordability and uptake of insurance products.

- Regulatory Compliance: While regulatory measures are essential for maintaining market stability, compliance with evolving regulations can pose challenges for insurance companies, particularly smaller firms with limited resources.

- Technological Advancements: The insurance industry is increasingly being shaped by technological innovations such as digital platforms, data analytics, and artificial intelligence. Adapting to these technological changes requires investment in infrastructure and skills development.

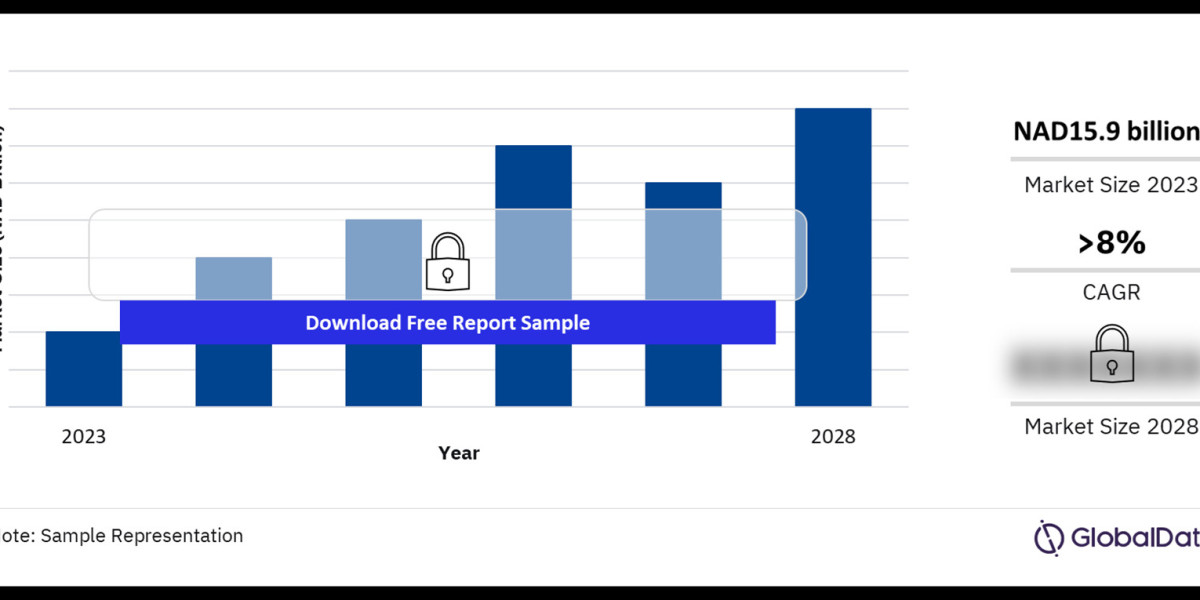

Growth Prospects

Despite the challenges, the Namibia insurance market holds significant growth potential. Factors contributing to this growth include:

- Economic Recovery: As Namibia's economy gradually recovers, the demand for insurance products is expected to rise. A growing middle class and increased urbanization are likely to drive the uptake of life and non-life insurance policies.

- Rising Awareness: Efforts by insurance companies and regulators to increase awareness about the importance of insurance are expected to contribute to higher penetration rates. Educational campaigns and financial literacy programs can help bridge the knowledge gap.

- Product Innovation: Insurance companies are increasingly focusing on product innovation to meet the changing needs of consumers. Customized insurance solutions, micro-insurance products, and health insurance offerings tailored to specific demographics can attract new customers.

- Digital Transformation: The adoption of digital technologies is transforming the insurance industry, making it more efficient and customer-centric. Online platforms for policy purchase, claims processing, and customer service enhance convenience and accessibility, attracting tech-savvy consumers.

Buy the Full Report for More Insights into the Namibia Insurance Market Forecast