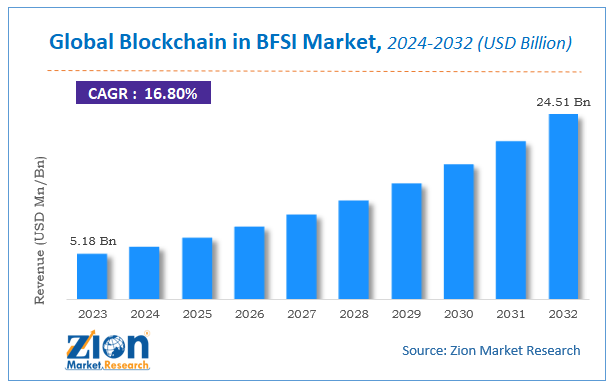

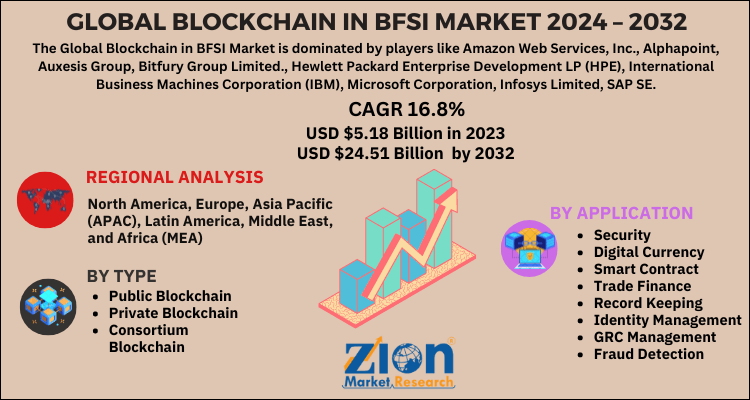

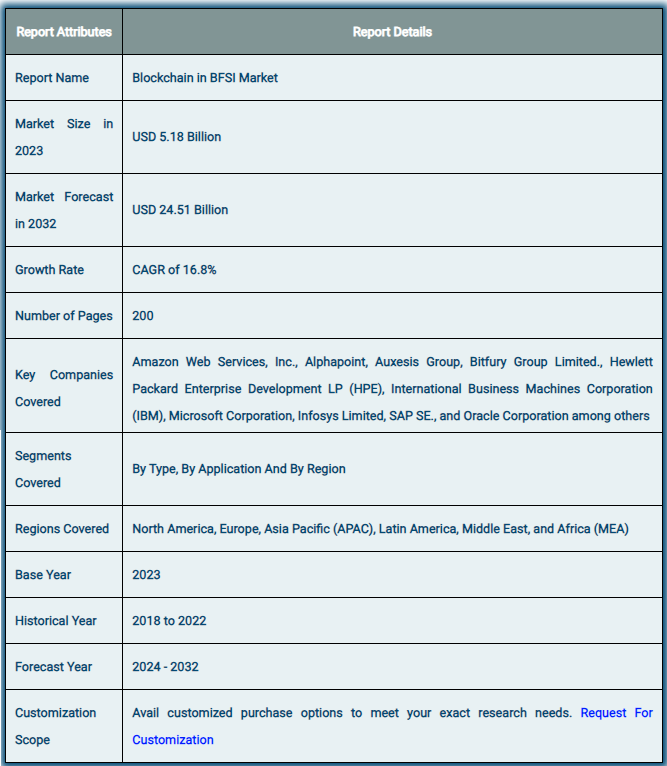

The worldwide blockchain market in the financial services industry was estimated to be worth USD 5.18 billion in 2024 and is expected to grow to USD 24.51 billion by the end of 2032, according to a report released by Zion Market Research. Over the course of the projection period, the market is anticipated to expand at a CAGR of 16.8%. The study examines the factors driving and impeding the growth of the worldwide Blockchain in the BFSI market as well as how they will affect demand going forward. Additionally, it will support navigating and investigating the Blockchain’s emerging potential in the BFSI sector.

Abstract

The integration of blockchain technology into the BFSI sector is revolutionizing how financial institutions operate, enhancing transparency, security, and efficiency. This research article provides an in-depth analysis of the blockchain in the BFSI market, exploring current trends, challenges, and future opportunities.

Introduction

- Background: Overview of blockchain technology and its relevance to the BFSI sector.

- Purpose: To analyze the impact, trends, and future prospects of blockchain technology in BFSI.

- Scope: Market segmentation, regional analysis, and technological advancements.

Global Blockchain in BFSI Market: Overview

An explicit sort of database which is different from a conventional database utilizing its data storing behavior is known as a blockchain. Such sort of databases holds digital data in blocks which is then chained together to generate a series of information. The input of fresh data in blockchain stored as fresh block data comes in it is recorded into a fresh block. Once these blocks are occupied with data, they are chained onto the previous block, which produces the chronological data chain. Various sorts of digital information can be kept on blockchain. However, presently, it is frequently used to retain records of transactions in the banking and finance industry.

Global Blockchain in BFSI Market: Growth Factors

The global blockchain in BFSI industry is rising at a quick clip. An increase in the demand for systematic client identification, rise in instances of hacking by cyber-criminals, and increase in use of blockchain in BFSI to lessen the counterparty risks are some of the major aspects that are driving to the growth of the global market.

Along with advances in efficiency and security, blockchain offers further benefits to the banking and financial industries such as quick transaction time, unchangeable records, and no third party association which eventually cuts the entire process expenses. Among all these aspects blockchain offers certain crucial advantages such as the history of unchangeable transactions.Transaction records in the blockchain cannot be edited or amended, these features supporting its acceptance in the banking and finance sector.

On the other side, higher energy consumption by some blockchain solutions and high reliability on nodes to work properly may limit the growth of the industry. However, factors such as faster transaction time and enhanced transaction accuracy will offer superior growth prospects to the worldwide blockchain in BFSI market over the forecast period. COVID 19 Epidemic conditions have inspired digital solutions in practically every area. Strict controls adopted by several governments to curb the spread of the sickness have led to restrictions of movements.

Hence digital banking transactions have expanded at an unprecedented rate. This has resulted in increasing demand for blockchain in the financial sector. Considering current pandemic scenarios pace of online transitions is predicted to increase over the projection period which in turn would boost the need for blockchain in the banking and financial industry.

Global Blockchain in BFSI Market: Segmentation

The global blockchain in BFSI market is segmented by type, application, and geography.Based on the type, the worldwide blockchain in BFSI market is segmented into the public blockchain, private blockchain, and consortium blockchain.

The application segment is separated into security, digital currency, smart contract, trade finance, record keeping, identity management, GRC management, and fraud detection. Digital currencies such as Bitcoin are mostly employing blockchain in the process.

Blockchain in BFSI Market: Report Scope

Global Blockchain in BFSI Market: Regional Analysis

North America is predicted to dominate the worldwide blockchain in BFSI market over the forecast period. Also, it is predicted to remain the top revenue generator in the worldwide blockchain in BFSI market over the future time. North America has well-developed banking and finance sector which is continuously implementing newer digital technology to better their services. Also, the presence of prominent industry players in the region is adding to the expansion of the market. Europe is predicted to remain the second largest market for blockchain in BFSI business. Growing investments by banking sectors on digital solutions to ensure the safety of the transactions are boosting the need for blockchain databases. Asia Pacific is predicted to be the most attractive market for blockchain in BFSI. Some of the causes that fuel the demand for blockchain in BFSI are increased worries regarding frauds & hacks in banking sectors of emerging countries such as India & China, government laws, and the massive banking industry.

Market Dynamics

- Drivers: Key factors propelling market growth.

- Increased need for security and fraud prevention.

- Demand for greater transparency and traceability.

- Enhancements in operational efficiency and cost reduction.

- Restraints: Challenges and barriers to market growth.

- Regulatory and compliance issues.

- Integration challenges with existing systems.

- Scalability concerns.

- Opportunities: Potential areas for market expansion.

- Growth in cross-border transactions and settlements.

- Integration with smart contracts and decentralized finance (DeFi).

Market Segmentation

- By Application: Payment and Settlement Systems Fraud Prevention and ComplianceTrade FinanceSmart ContractsIdentity ManagementOthers

- By End-User:BanksInsurance Companies Investment FirmsPayment Service Providers

- By Technology:Public BlockchainPrivate BlockchainConsortium Blockchain

Regional Analysis

- North America:Market trends and growth drivers.Key players and competitive landscape.

- Europe:Regional market dynamics and opportunities.

- Asia-Pacific:Growth potential and emerging markets.

- Rest of the World:Market insights and future prospects.

Technological Advancements

- Smart Contracts: Automation and efficiency in contract execution.

- Decentralized Finance (DeFi): Emerging trends and impacts on traditional financial services.

- Blockchain Interoperability: Enhancing cross-chain communication and data sharing.

- Regulatory Technology (RegTech): Using blockchain for compliance and regulatory reporting.

Competitive Landscape

- Key Players:Profiles of major market players (e.g., IBM, Microsoft, Ripple, Chainalysis).Recent developments and strategies.

- Market Share Analysis:Market share of top players.Competitive strategies and market positioning.

Future Outlook

- Market Forecast: Predictions for market growth over the next decade.

- Emerging Trends: Anticipated technological and market trends.

- Strategic Recommendations: Suggestions for stakeholders and market participants.

Conclusion

- Summary of Findings: Key takeaways from the research.

- Implications: Implications for industry stakeholders.

- Future Research: Areas for further research and analysis.

Contact Us:

Zion Market Research212

USA/Canada Toll Free: 1 (855) 465–4651

Newark: 1 (302) 444–016611\s

Web: https://www.zionmarketresearch.com/

Blog: https://zmrblog.com/

Browse other trend reports:

https://www.zionmarketresearch.com/report/cloud-database-dbaas-market

https://www.zionmarketresearch.com/report/cloud-migration-services-market

https://www.zionmarketresearch.com/report/cloud-mobile-backend-service-market

https://www.zionmarketresearch.com/report/digital-security-control-market

https://www.zionmarketresearch.com/report/surface-analysis-market

https://www.zionmarketresearch.com/report/graph-analytics-market

https://www.zionmarketresearch.com/report/small-domestic-appliances-market

https://www.zionmarketresearch.com/report/broad-ion-beam-technology-market

https://www.zionmarketresearch.com/report/tunnel-lighting-market

https://www.zionmarketresearch.com/report/ultra-mobile-devices-market

https://www.zionmarketresearch.com/report/smart-ticketing-market

https://www.zionmarketresearch.com/report/bring-your-own-device-security-market

https://www.zionmarketresearch.com/report/home-standby-gensets-market

https://www.zionmarketresearch.com/report/digital-ad-spending-market

https://www.zionmarketresearch.com/report/intranet-as-a-service-market

https://www.zionmarketresearch.com/report/blockchain-in-bfsi-market

https://www.zionmarketresearch.com/report/online-home-decor-market

https://www.zionmarketresearch.com/report/gene-delivery-technologies-market

https://www.zionmarketresearch.com/report/wearable-fitness-tracker-market

https://www.zionmarketresearch.com/report/magnesium-sulphate-market