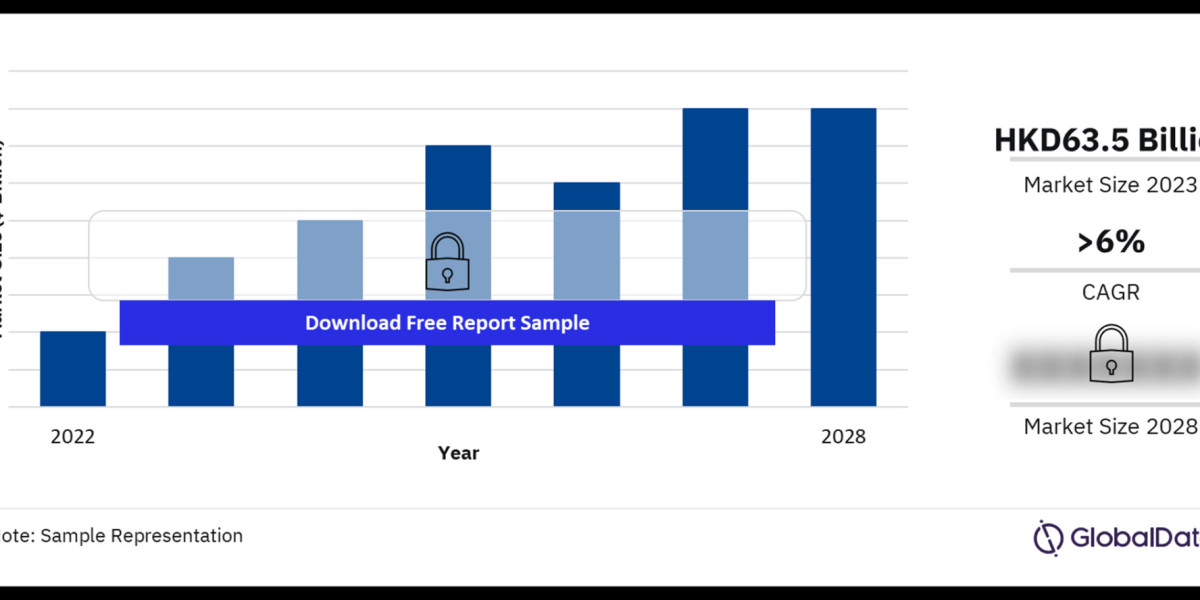

Market Size and Structure

As of March 2024, Hong Kong's insurance landscape comprised 160 authorized insurers, with 87 dedicated solely to general insurance [Insurance Authority]. The market is competitive, with a healthy mix of local and international players. Interestingly, gross premiums saw a slight dip in 2022, but analysts predict a rebound with a growth rate of 5.5% in 2024 and 2025 [GlobalData].

Product Landscape: Diversity and Dominance

Hong Kong's general insurance market offers a wide range of products catering to various needs. Property damage, general liability, and pecuniary loss insurance form a significant portion of the market. However, the true leader is personal accident and health (PA&H) insurance, accounting for over 30% of the total general insurance gross written premium (GWP) in 2023 [GlobalData]. This dominance can be attributed to factors like rising medical inflation and a growing focus on health security.

Growth Drivers: A Multi-Faceted Force

Several factors are propelling the growth of Hong Kong's general insurance market. Mandatory insurance classes, like those for motor vehicles and third-party liability, create a steady stream of premiums. Additionally, the increasing demand for health and travel insurance, particularly from mainland Chinese customers, is a significant growth driver. The Greater Bay Area (GBA) initiative further presents exciting opportunities for cross-border collaboration within the insurance sector.

Technological Transformation: Embracing the Digital Future

The rise of InsurTech (insurance technology) is significantly impacting the Hong Kong market. Traditional insurers are actively embracing digitalization to enhance customer experience, streamline processes, and offer innovative products. This includes utilizing big data analytics for risk assessment, developing user-friendly online platforms for policy purchases and claims management, and leveraging telematics in motor insurance.

Challenges and the Road Ahead

Despite its strengths, the Hong Kong general insurance market faces certain challenges. Intense competition can lead to price wars, potentially impacting profitability. Additionally, evolving regulations and cyber threats require constant vigilance and adaptation. To stay ahead, insurers must focus on innovation, personalized offerings, and data-driven risk management strategies.

Buy the Full Report to Gain More Information about Hong Kong General Insurance Market Forecast