The global motor insurance market acts as a safety net for drivers, offering financial protection in the event of accidents. This intricate market plays a crucial role in ensuring financial stability for individuals and fostering a sense of security on the roads. This article delves into the world of motor insurance, exploring its global reach, market size, growth drivers, key players, and future prospects.

Buckling Up for the Ride: Market Size and Geographical Landscape

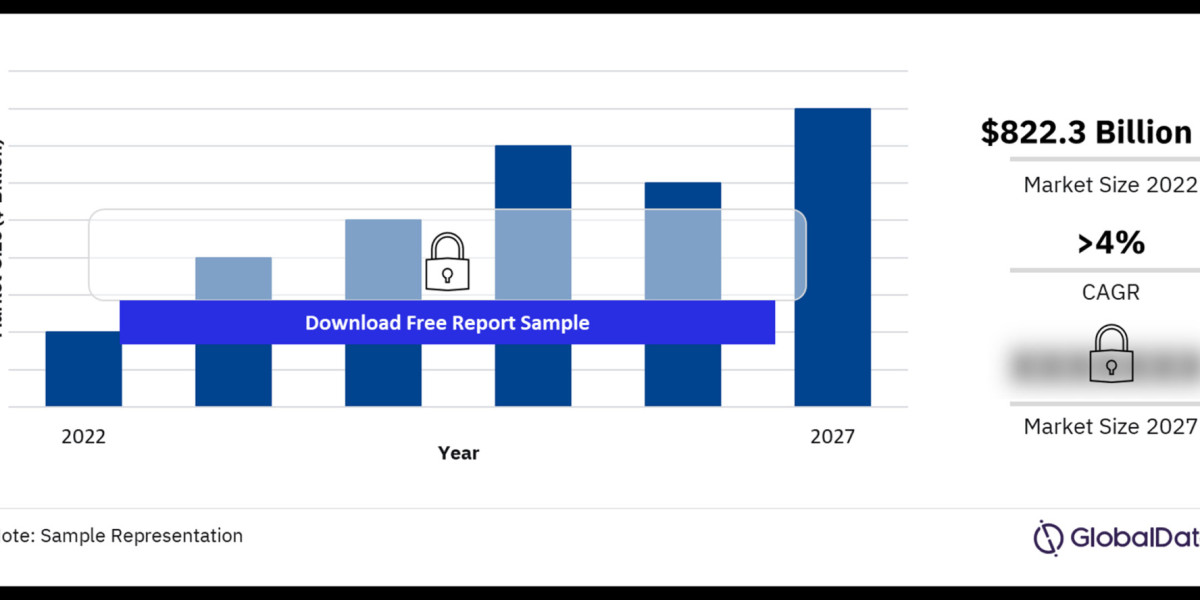

The global motor insurance market is a significant economic powerhouse. According to Allied Market Research, the market size was estimated at a staggering USD 1.3 trillion in 2023 and is projected to reach a value of USD 1.8 trillion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 4.2%. This growth is driven by factors prevalent across various geographical regions.

Fueling the Engine: Drivers of Growth

Several key factors propel the global motor insurance market forward:

- Rising Vehicle Ownership: The increasing number of vehicles on the road globally translates to a larger pool of potential policyholders seeking insurance coverage.

- Growing Urbanization: Densely populated urban areas witness higher accident rates, driving the demand for motor insurance to mitigate financial risks.

- Mandated Insurance: Many countries have regulations mandating car owners to carry minimum levels of motor insurance, ensuring financial protection for all road users.

- Technological Advancements: The integration of telematics in car insurance (usage-based insurance) personalizes premiums based on driving behavior and can incentivize safer driving practices.

- Increased Insurance Awareness: Growing public awareness of the benefits and legal requirements of motor insurance leads to higher adoption rates.

Navigating the Highway: Market Segmentation

The global motor insurance market can be segmented based on various factors:

- Coverage Type: This includes Third-Party Liability (TPL), which covers damage to others; Comprehensive Coverage, offering protection for both the insured and the involved third party; and Collision Coverage, providing additional protection for the policyholder's vehicle.

- Distribution Channels: Insurance can be purchased directly from insurance companies, through brokers or agents, or increasingly, through online platforms.

- Vehicle Type: Motor insurance policies cater to various vehicle segments, from private cars and motorcycles to commercial vehicles and trucks.

The Key Players at the Wheel:

The global motor insurance market is a competitive landscape with established players and regional giants vying for market share. Some prominent names include:

- Multinational Insurance Companies: Global giants like AXA, Allianz, and Chubb offer motor insurance coverage across various countries.

- Regional Insurance Leaders: Companies like Ping An Insurance (China), State Farm (United States), and Bajaj Allianz (India) hold significant market share in their respective regions.

- Emerging InsurTech Players: Innovative startups are leveraging technology to disrupt the traditional insurance model, offering personalized coverage and streamlined processes.

Shifting Gears: Future Trends Shaping the Market

The global motor insurance market is on the cusp of significant transformation, driven by several emerging trends:

- Autonomous Vehicles: The rise of self-driving cars will necessitate new insurance models and liability considerations, potentially impacting traditional premium structures.

- Connected Car Technology: The increasing integration of connected car technology allows insurers to gather real-time driving data, further influencing risk assessment and personalized pricing.

- Cybersecurity Concerns: As cars become more connected, cybersecurity threats emerge, requiring insurance solutions to address potential cyberattacks and data breaches.

- Focus on Usage-Based Insurance (UBI): UBI models that tailor premiums based on individual driving behavior are likely to gain traction, rewarding safe drivers with lower costs.

Conclusion: A Roadmap for a Secure Future

The global motor insurance market plays a critical role in promoting road safety and financial security. As technology evolves and consumer preferences shift, the market will continue to adapt. By embracing innovation, focusing on risk management, and offering diverse coverage options, the motor insurance industry can ensure a smoother and safer journey for all drivers on the global highway.

Buy Full Report for More Insights into the Motor Insurance Market Forecast