A Well-Regulated Environment

The Central Bank of Curaçao and Sint Maarten (CBCS) acts as the chief regulatory body for the insurance sector. The CBCS enforces a strict framework ensuring financial stability and consumer protection. This focus on regulations fosters a secure environment for insurance companies to operate and policyholders to invest their trust.

Open for Business: A Welcoming Landscape

One of the most attractive aspects of the Curaçao insurance market is its openness to foreign investment. With 100% Foreign Direct Investment (FDI) permitted, the island welcomes international insurers and reinsurers. This fosters healthy competition within the market, ultimately benefiting consumers with a wider range of insurance products and competitive pricing.

Market Segmentation: Catering to Diverse Needs

The Curaçao insurance market offers a variety of insurance products, broadly classified into two categories: life and non-life insurance.

Life Insurance: Life insurance products in Curaçao cater to various needs, from traditional whole life and term life policies to more sophisticated investment-linked plans. These plans provide financial security for beneficiaries in the event of the policyholder's death.

Non-Life Insurance: The non-life insurance segment offers a wider range of coverage options. Some popular categories include:

- Property Insurance: Protects homes and businesses from damage caused by fire, natural disasters, and theft.

- Motor Insurance: Mandatory third-party liability insurance safeguards against financial repercussions arising from accidents involving your vehicle. Optional comprehensive coverage offers additional protection for your car.

- Health Insurance: Curaçao offers various health insurance plans, ranging from basic coverage to comprehensive options that encompass hospitalization and medical expenses.

- Other Non-Life Products: Additional insurance products like marine, aviation, and professional liability insurance cater to specialized needs.

Distinct Features: Setting Curaçao Apart

The Curaçao insurance market offers several unique advantages that distinguish it from other Caribbean islands:

- Focus on Innovation: Curaçao insurers are increasingly adopting technological advancements to streamline processes and enhance customer service.

- Multilingual Support: Catering to a diverse clientele, many insurers provide multilingual support, ensuring clear communication and eliminating language barriers.

- Tax Advantages: Curaçao offers attractive tax benefits for insurance companies, making it a cost-effective location for international operations.

Looking Ahead: The Future of Curaçao Insurance

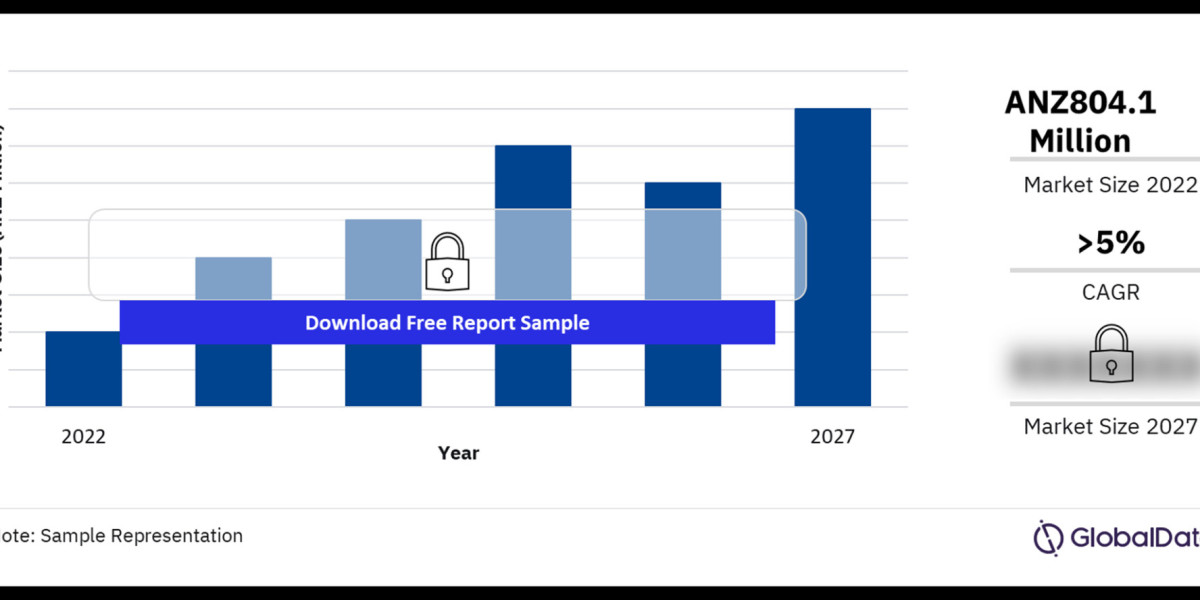

The Curaçao insurance market is poised for continued growth. Rising disposable incomes, increasing awareness of financial security, and a growing expatriate population are expected to fuel demand for insurance products. The market's focus on regulatory compliance, innovation, and customer service will likely solidify its position as a premier insurance hub in the Caribbean region.

Buy the Full Report for More Insights into the Curacao Insurance Market Forecast