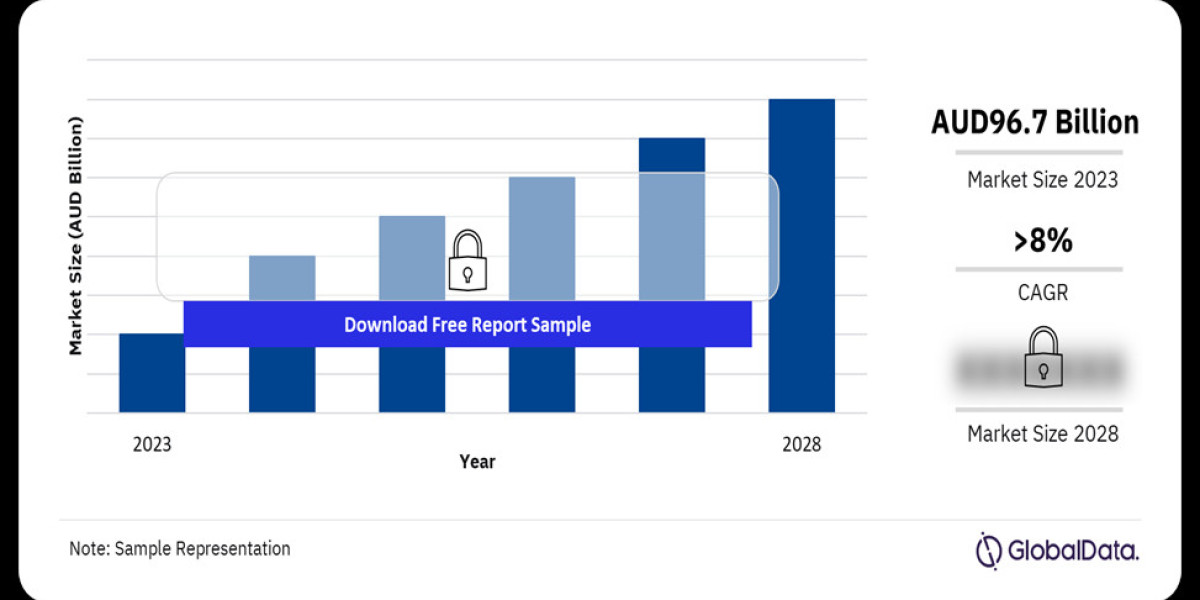

Market Size and Growth:

The Australian general insurance market boasts impressive growth. According to IBISWorld, the industry revenue has reached an estimated $99.8 billion in 2024, reflecting a Compound Annual Growth Rate (CAGR) of 4.8% over the past five years. This upward trend is expected to continue, with projections indicating steady growth in the coming years.

Product Landscape:

The Australian general insurance market caters to a diverse range of needs through a variety of product lines. Some of the most prominent ones include:

- Motor Vehicle Insurance: Protecting individuals against financial losses arising from accidents, theft, or damage to their vehicles. This remains one of the largest segments within the market.

- Home and Contents Insurance: Safeguarding homes and their contents against perils like fire, theft, natural disasters, and accidental damage.

- Fire and Industrial Special Risks (ISR) Insurance: Providing coverage for businesses against property damage or loss due to fire, explosions, or other specialized industrial risks.

- Public and Product Liability Insurance: Shielding businesses from legal liabilities arising from injuries sustained by third parties on their premises or due to defective products.

- Professional Indemnity Insurance: Protecting professionals like accountants, lawyers, and engineers from financial repercussions of negligence claims.

- Other Important Segments:

- Employers' liability insurance

- Mortgage and consumer credit insurance

- Travel insurance

- Cyber insurance

- Reinsurance (acts as insurance for insurance companies)

Recent Trends:

The Australian general insurance market is constantly evolving, with several key trends shaping its future:

- Technological Innovation: Insurers are increasingly leveraging technology to streamline processes, personalize offerings, and enhance customer experiences. This includes automation, data analytics, and the use of artificial intelligence (AI).

- Rising Claims Costs: The industry has witnessed an increase in claim costs, driven by factors like severe weather events, escalating repair costs, and medical inflation.

- Cybersecurity Threats: Growing dependence on technology has amplified cyber threats, prompting a surge in demand for cyber insurance products.

- Regulatory Changes: The regulatory landscape is constantly changing, and insurers need to adapt their practices to comply with evolving regulations.

Major Players:

The Australian general insurance market is a competitive space with a presence of both domestic and international players. Some of the leading insurers include:

- Allianz Australia

- AIA Australia

- Aviva

- Chubb

- IAG (Insurance Australia Group)

- Suncorp Group

- QBE Insurance

Looking Ahead:

The Australian general insurance market is poised for continued growth, driven by rising risk awareness, technological advancements, and the increasing complexity of risks faced by individuals and businesses. As the market evolves, insurers that can effectively adapt to these trends and deliver innovative solutions will be well-positioned to thrive in this competitive environment.

Buy the Full Report to Gain More Information about the Australia General Insurance Market Forecast, Download a Free Report Sample