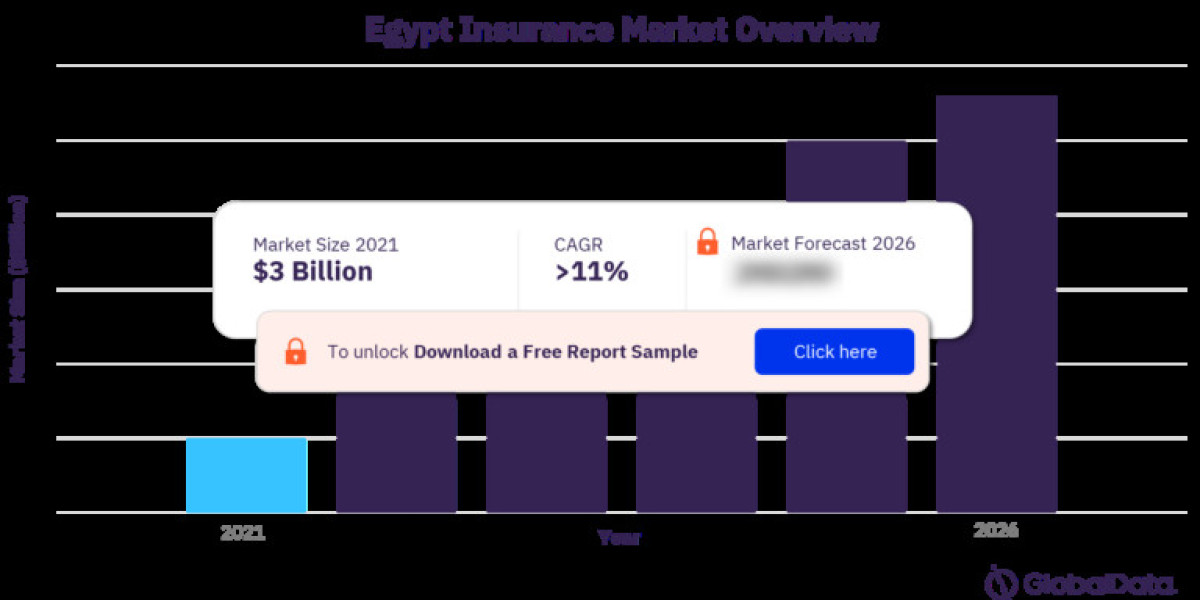

The Current State of Egypt's Insurance Industry

Egypt's insurance industry, while growing, still has a relatively low penetration rate compared to developed markets. Non-life insurance dominates the market, primarily driven by motor insurance, followed by property and fire insurance. Life insurance, though growing steadily, accounts for a smaller portion of the overall market.

Key Trends:

- Digital Transformation: The industry is embracing technology to enhance customer experience, improve operational efficiency, and expand product offerings.

- Product Innovation: Insurers are developing tailored products to cater to the specific needs of different segments of the population.

- Regulatory Reforms: The government's efforts to modernize the regulatory framework are creating a conducive environment for industry growth.

- Foreign Investment: Increased foreign interest in Egypt's insurance sector is bringing in new capital and expertise.

Challenges Facing the Industry

- Low Insurance Penetration: Despite the growing economy, a large segment of the population remains uninsured.

- Underdeveloped Insurance Culture: There is a lack of awareness about the benefits of insurance among the general public.

- Talent Shortage: The industry faces a shortage of qualified professionals, particularly in actuarial science and risk management.

- Economic Volatility: Egypt's economy is susceptible to external shocks, which can impact the insurance industry's performance.

Opportunities for Growth

- Expanding Product Range: There is significant potential for growth in areas such as health insurance, life insurance, and agricultural insurance.

- Targeting Underserved Segments: Insurers can focus on reaching out to rural populations and low-income segments.

- Leveraging Technology: Digital platforms can be used to distribute insurance products, reduce costs, and enhance customer engagement.

- Collaborations and Partnerships: Strategic alliances with banks, telecommunications companies, and other financial institutions can expand market reach.

For more insights on this report, download a free report sample