The financial landscape in Sweden is undergoing significant changes, with the cards and payments market at the forefront of this transformation. This market is characterized by a shift from cash-based transactions to digital payments, spurred by technological advancements, a strong banking infrastructure, and consumer preferences for convenience and security. In this article, we will explore the key trends, market dynamics, and future outlook for the Sweden cards and payments market.

1. Market Size and Growth

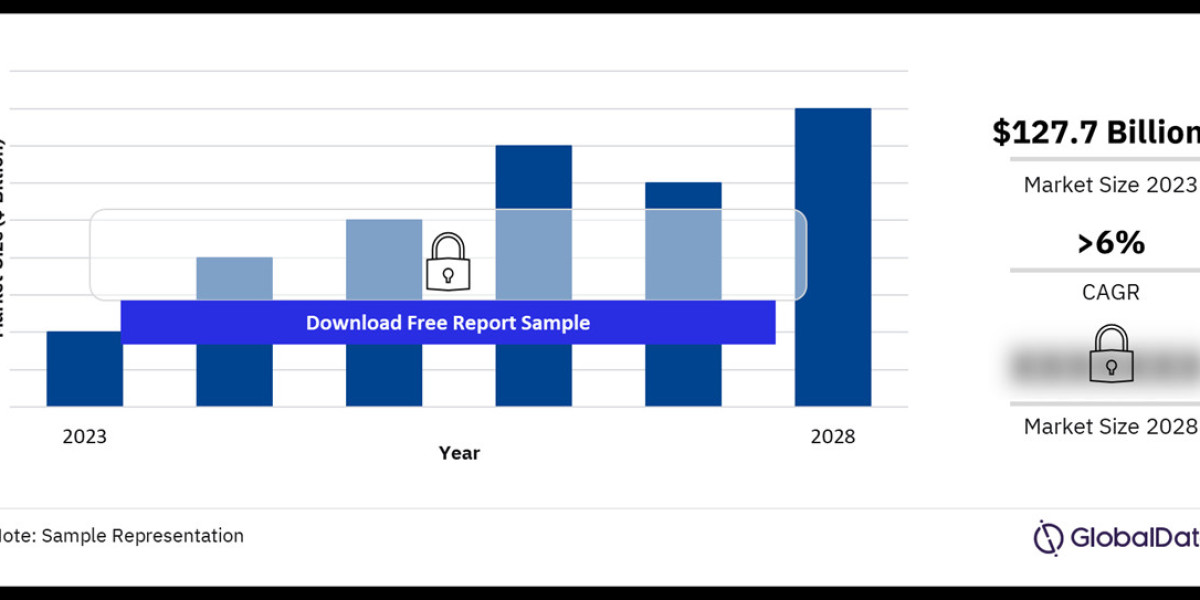

The Sweden cards and payments market has shown steady growth over the past few years, with an increasing number of consumers adopting card payments for everyday transactions. The market is primarily driven by the high penetration of payment cards, widespread use of mobile payment solutions, and a strong push towards a cashless society. According to industry reports, Sweden is one of the most cashless societies globally, with cash usage accounting for less than 10% of all payments.

2. Types of Payment Cards in Sweden

The payment card market in Sweden is dominated by two main types of cards: credit cards and debit cards.

Debit Cards: These are the most popular payment cards in Sweden, widely used for both online and offline transactions. Major banks such as Swedbank, Handelsbanken, and SEB offer debit cards that are linked directly to consumers' bank accounts, providing a convenient way to manage daily expenses.

Credit Cards: Although less common than debit cards, credit cards are gaining popularity due to the added benefits they offer, such as reward points, cashback, and travel insurance. Leading credit card issuers in Sweden include Nordea, Swedbank, and Danske Bank.

3. Mobile Payments and Digital Wallets

Mobile payments are becoming increasingly popular in Sweden, driven by the growing adoption of smartphones and the convenience of contactless payments. Swish, a mobile payment app developed by Sweden’s major banks, has become a dominant player in the market, allowing users to make instant payments to individuals and businesses using their mobile phones. Other popular digital wallets include Apple Pay, Google Pay, and Samsung Pay, which are gaining traction among tech-savvy consumers.

4. Key Drivers of the Market

Several factors are contributing to the growth of the cards and payments market in Sweden:

High Internet and Smartphone Penetration: Sweden boasts one of the highest internet and smartphone penetration rates in Europe, facilitating the adoption of online banking and mobile payment solutions.

Government Support for a Cashless Society: The Swedish government has been actively promoting a cashless society, encouraging the use of digital payments for increased efficiency and security. This initiative is supported by a robust regulatory framework that ensures the safety of digital transactions.

Innovative Payment Solutions: Swedish banks and fintech companies are at the forefront of developing innovative payment solutions that cater to the evolving needs of consumers. The introduction of contactless payments, biometric authentication, and blockchain technology is reshaping the payment landscape in Sweden.

5. Challenges Facing the Market

Despite the positive growth trajectory, the Sweden cards and payments market faces several challenges:

Security Concerns: As digital payments become more prevalent, concerns about cybersecurity and data breaches are on the rise. Consumers and businesses alike are wary of potential fraud and identity theft, which could hamper the growth of the market.

Competition from New Entrants: The market is becoming increasingly competitive, with new entrants such as fintech startups and global payment giants challenging the dominance of traditional banks. This competition is driving innovation but also putting pressure on margins.

Consumer Trust and Privacy: While digital payments offer convenience, consumers are becoming more conscious of their privacy and the security of their personal information. Building and maintaining consumer trust is crucial for the sustained growth of the market.

6. Future Outlook

The future of the Sweden cards and payments market looks promising, with several trends likely to shape its development:

Increased Adoption of Contactless Payments: Contactless payments are expected to become the norm in Sweden, driven by the convenience and speed they offer. The COVID-19 pandemic has further accelerated this trend, as consumers and businesses seek safer, contact-free payment methods.

Expansion of Digital Wallets: The use of digital wallets is set to grow, with more consumers opting for mobile payment solutions over traditional card payments. This shift is supported by the increasing acceptance of digital wallets by merchants and service providers.

Focus on Security and Compliance: As the market grows, so will the emphasis on enhancing security measures and compliance with regulatory requirements. The adoption of advanced technologies such as biometric authentication and blockchain will play a key role in ensuring the security of digital transactions.

Collaboration Between Banks and Fintechs: Collaboration between traditional banks and fintech companies will drive innovation and provide consumers with a wider range of payment options. These partnerships are likely to focus on enhancing the user experience, improving security, and offering value-added services.

Buy the Full Report for More Information on the Sweden Cards and Payments Market Forecast Download a Free Sample Report