Offshore wealth management has become an increasingly popular strategy for high-net-worth individuals (HNWIs), family offices, and corporations seeking to diversify their investment portfolios, protect their assets, and take advantage of favorable tax regimes. The offshore wealth management market, which includes banking, investment advisory, and financial planning services offered outside an individual's home country, has evolved significantly over the years. This article delves into the key trends, opportunities, and challenges that shape the offshore wealth management market today.

What is Offshore Wealth Management?

Offshore wealth management involves managing and growing the assets of individuals or entities outside their country of residence. This practice is often utilized to access investment opportunities in different markets, benefit from advantageous tax conditions, and enhance the privacy and security of assets. Offshore wealth management services typically include asset management, tax planning, estate planning, and financial advisory services, provided by specialized firms or banks located in jurisdictions known for their favorable financial regulations.

Market Trends in Offshore Wealth Management

- Increased Demand for Diversification and Global ExposureInvestors are increasingly seeking to diversify their portfolios to mitigate risks associated with domestic economic downturns and currency fluctuations. Offshore wealth management offers access to a broader range of investment options, including international equities, bonds, real estate, and alternative assets like private equity and hedge funds. This global exposure helps investors achieve a more balanced and resilient portfolio.

- Rising Adoption of Digital PlatformsThe digital transformation of the financial services industry has also impacted the offshore wealth management market. Digital platforms and robo-advisors are becoming more common, offering clients easier access to investment management and advisory services. These technologies enhance efficiency, transparency, and client engagement, enabling offshore wealth managers to serve clients more effectively and at a lower cost.

- Focus on Regulatory Compliance and TransparencyWith increasing scrutiny from global regulators and the implementation of regulations such as the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA), offshore wealth managers are prioritizing compliance and transparency. These regulations aim to prevent tax evasion and ensure that offshore wealth management practices adhere to international standards. As a result, offshore jurisdictions are adopting stricter regulatory frameworks, enhancing the credibility and stability of the market.

- Sustainability and ESG InvestingEnvironmental, Social, and Governance (ESG) considerations are becoming a significant focus for offshore investors. Wealth managers are increasingly incorporating ESG criteria into their investment strategies to meet the growing demand for sustainable and socially responsible investing. This trend is driving the development of new investment products and services that align with clients' values and long-term sustainability goals.

Opportunities in the Offshore Wealth Management Market

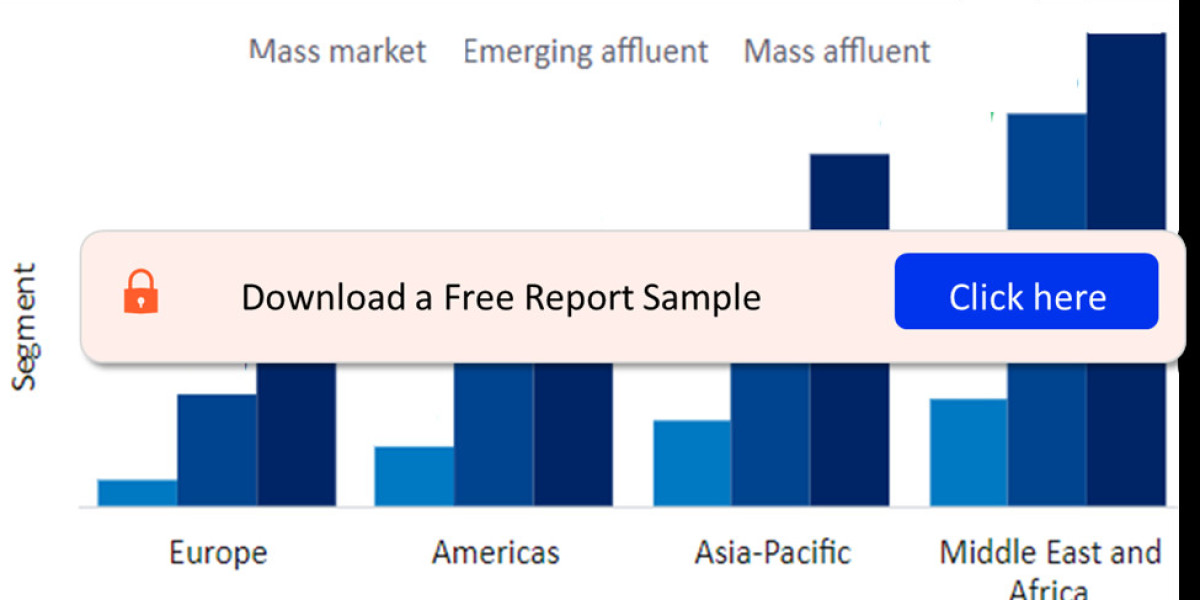

- Expansion into Emerging MarketsThe offshore wealth management market has significant growth potential in emerging markets, where the number of HNWIs is rising rapidly. Countries in Asia, the Middle East, and Latin America present attractive opportunities for offshore wealth managers to expand their client base and tap into new investment opportunities. These regions offer a growing pool of investors seeking diversification and wealth preservation solutions.

- Tailored Services for Ultra-High-Net-Worth Individuals (UHNWIs)UHNWIs have unique and complex financial needs, requiring bespoke wealth management solutions. Offshore wealth managers can capitalize on this opportunity by offering personalized services that cater to the specific requirements of UHNWIs, such as estate planning, succession planning, and philanthropy advisory. Building strong relationships with these clients can lead to long-term partnerships and increased assets under management.

- Leveraging Technology and InnovationTechnological advancements provide offshore wealth managers with tools to enhance client experiences, improve operational efficiency, and offer innovative investment solutions. By leveraging big data analytics, artificial intelligence (AI), and blockchain technology, wealth managers can gain deeper insights into client preferences, optimize portfolio management, and provide more secure and transparent transactions.

Challenges Facing the Offshore Wealth Management Market

- Regulatory Compliance and Legal RisksThe offshore wealth management industry faces complex regulatory challenges, as different jurisdictions have varying laws and regulations. Ensuring compliance with international standards while adapting to local regulations can be a daunting task. Additionally, the risk of reputational damage due to non-compliance or involvement in illicit activities, such as money laundering, remains a concern for wealth managers.

- Political and Economic UncertaintyGeopolitical tensions, economic instability, and changes in tax laws can impact the offshore wealth management market. Investors may face uncertainties related to currency exchange rates, inflation, and government policies, which can affect the performance of offshore investments. Wealth managers must stay vigilant and adapt their strategies to navigate these challenges effectively.

- Privacy and Data Security ConcernsAs digitalization becomes more prevalent, data security and privacy concerns are growing. Offshore wealth managers must invest in robust cybersecurity measures to protect sensitive client information from cyber threats and data breaches. Maintaining client confidentiality and trust is crucial for the success of offshore wealth management services.

Buy the Full Report for More Offshore Wealth Management Insights