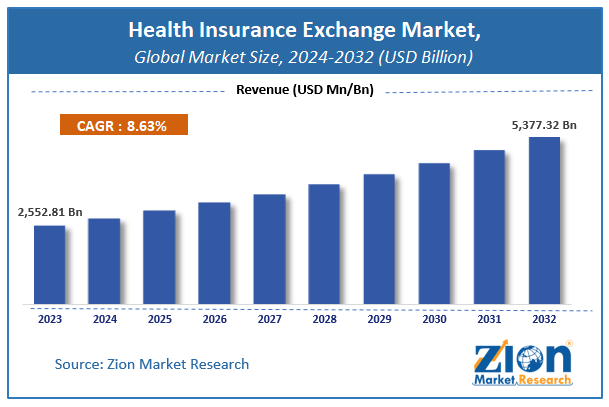

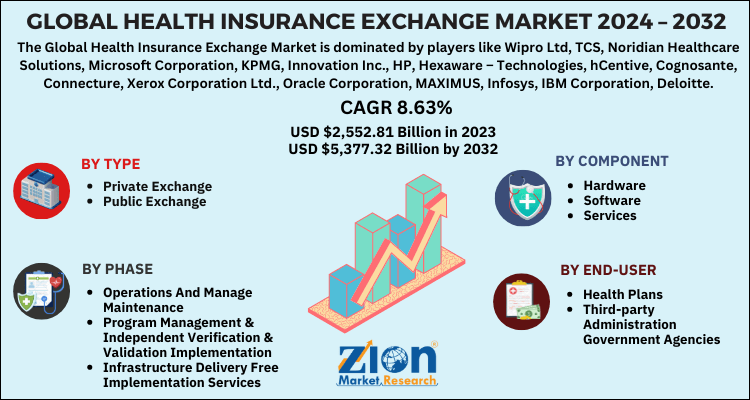

The global health insurance exchange market was estimated to be worth USD 2,552.81 billion in 2024 and is expected to grow to USD 5,377.32 billion by the end of 2032, according to a report released by Zion Market Research. Over the course of the projection period, the market is anticipated to expand at a CAGR of 8.63%. The study examines the factors that will propel growth, impede it, and affect demand in the worldwide health insurance exchange market over the course of the projected period. Additionally, it will support exploration and navigation of the emerging opportunities in the Health Insurance Exchange sector.

Abstract:

The Health Insurance Exchange Market has been evolving rapidly, driven by regulatory changes, technological advancements, and shifts in consumer behavior. Health insurance exchanges, both public and private, provide platforms for individuals and businesses to compare and purchase health insurance plans. This article examines the current state of the Health Insurance Exchange Market, identifies key trends and drivers, explores challenges facing the industry, and outlines future opportunities for growth.

Introduction:

Health insurance exchanges are platforms designed to facilitate the comparison, selection, and purchase of health insurance plans. These exchanges play a crucial role in the healthcare system by increasing transparency, competition, and accessibility. With the implementation of health reforms and the growing emphasis on consumer choice and affordability, the Health Insurance Exchange Market is experiencing significant transformation. This article provides an overview of the market landscape, including key developments, market dynamics, and future directions.

Overview of the Global Health Insurance Exchange Market

One new trend in the online market is the health insurance exchange. The phrase “private sector technology,” which refers to various service providers helping states develop their exchanges efficiently, is well known among stakeholders, the federal government, state governments, and the private sector. The technology was created following years of involvement with Medicare Advantage, the managed Medicaid sector, and a variety of creative ways for eligible health plans to provide insurance to consumers on the health insurance exchange market.

Growth Factors for the Global Health Insurance Exchange Market

The expansion of government financing sources, such as federal health insurance requirements and other successful programs, is one of the key reasons propelling the growth of the global health insurance exchange market. Because healthcare services will become much more affordable, it is anticipated to reduce health care costs and benefit a great deal of people. The healthcare industry’s booming use of IT technology will significantly fuel the global market’s expansion. In addition, people’s increasing awareness of cloud-based technology and the advantages of incorporating cutting-edge technology into healthcare business procedures would probably encourage the use of health insurance exchange solutions in the upcoming year.

The Affordable Care Act (ACA) states that the health insurance exchange aims to create a list of vendors by providing various services, such as qualifying plans.

Qualified plans are designed to assist vendors in meeting the requirements outlined in the Affordable Care Act. The fierce rivalry among the service providers will greatly encourage them to produce higher-quality services at more reasonable costs. The core of Obamacare in the US is the idea of a health insurance exchange.

Under these schemes, many internet retailers offer a variety of medical benefits. Creating an expeditious for medical coverage is the main goal of this online marketplace for purchasing and selling commercial insurance. It is designed to keep insurance firms from competing with one another and to prevent cheap policies. Over the course of the projection period, the increased investments from stakeholders and the government are expected to favourably affect the trajectory of the global health insurance exchange market.

Segmentation of the Global Health Insurance Exchange Market

There are various segments within the global health insurance exchange market, including end-user, component, phase, type, and geography.

The market can be divided into health plans, government organisations, third-party administration, and other end users.

The market can be divided into hardware, software, and services segments based on the components.

The market can be divided by phase into segments such as infrastructure delivery free implementation services, program management & independent verification & validation implementation, operations and manage maintenance, and others.

The market can be divided into private exchange and public exchange categories based on kind.

Market for Health Insurance Exchanges: Report Purpose

Regional overview of the global health insurance exchange market

Because the region has many beneficial regulations that allow consumers to receive affordable healthcare services, North America holds the highest proportion of the global market for health insurance exchanges.

Along with cutting-edge technologies including system integration, exchange implementation, planning & designing, project management operation, and maintenance solutions, the region’s notable IT suppliers will also contribute to the growth of the industry.

Due to the government’s and notable leaders’ aggressive efforts to fortify the region’s IT and healthcare infrastructures, Europe is probably going to experience continuous growth in the years to come.

Asia Pacific and a number of other regions of the world do not currently have any stake in this market, but as information technology advances and public awareness of the advantages of health insurance exchanges grows, it is expected that health insurance exchange solutions will be implemented in the region.

Market Overview:

- Current Market Size and Growth Rate:

- Key Market Segments:

Key Market Drivers:

- Regulatory Changes and Health Reforms:

- Technological Advancements:

- Growing Demand for Consumer Choice and Transparency:

- Rising Healthcare Costs:

Challenges Facing the Market:

- Complexity and Navigation Issues:

- Privacy and Security Concerns:

- Regulatory and Compliance Challenges:

- Market Competition and Fragmentation:

Regional Analysis:

- North America: The largest market, driven by regulatory frameworks such as the ACA, advanced technological infrastructure, and a high level of consumer engagement. The U.S. and Canada have well-established exchanges with significant market activity.

- Europe: Growing interest in health insurance exchanges due to varying national healthcare systems and regulatory environments. Countries like Germany, the UK, and France are leading in the adoption of digital platforms.

- Asia-Pacific: Emerging market with increasing adoption of health insurance exchanges, driven by rising healthcare costs, growing middle-class population, and government initiatives to improve healthcare access.

- Latin America & Middle East & Africa: Developing markets with potential for growth. Challenges include varying levels of infrastructure, regulatory environments, and consumer awareness.

Future Outlook:

The Health Insurance Exchange Market is expected to continue evolving, with several key trends shaping its future. Technological innovations, such as enhanced AI-driven tools and improved data analytics, will likely drive greater efficiency and personalization in exchanges. Increased focus on consumer experience and engagement will lead to more intuitive and user-friendly platforms.

Regulatory changes and health reforms will continue to influence the market, potentially leading to new models and frameworks for exchanges. Additionally, the growing emphasis on value-based care and integrated health services may drive further integration of insurance exchanges with broader healthcare systems.

As the market matures, collaboration between stakeholders, including insurers, technology providers, and regulatory bodies, will be crucial in addressing challenges and leveraging opportunities for growth.

Conclusion:

The Health Insurance Exchange Market is a dynamic and rapidly evolving sector, influenced by regulatory changes, technological advancements, and shifting consumer expectations. While challenges such as complexity, privacy concerns, and regulatory compliance persist, the opportunities for growth and innovation are significant. As the market continues to evolve, health insurance exchanges will play an increasingly important role in providing accessible, affordable, and transparent health insurance options to individuals and businesses.

Contact Us:

Zion Market Research212

USA/Canada Toll Free: 1 (855) 465–4651

Newark: 1 (302) 444–016611\s

Web: https://www.zionmarketresearch.com/

Blog: https://zmrblog.com/