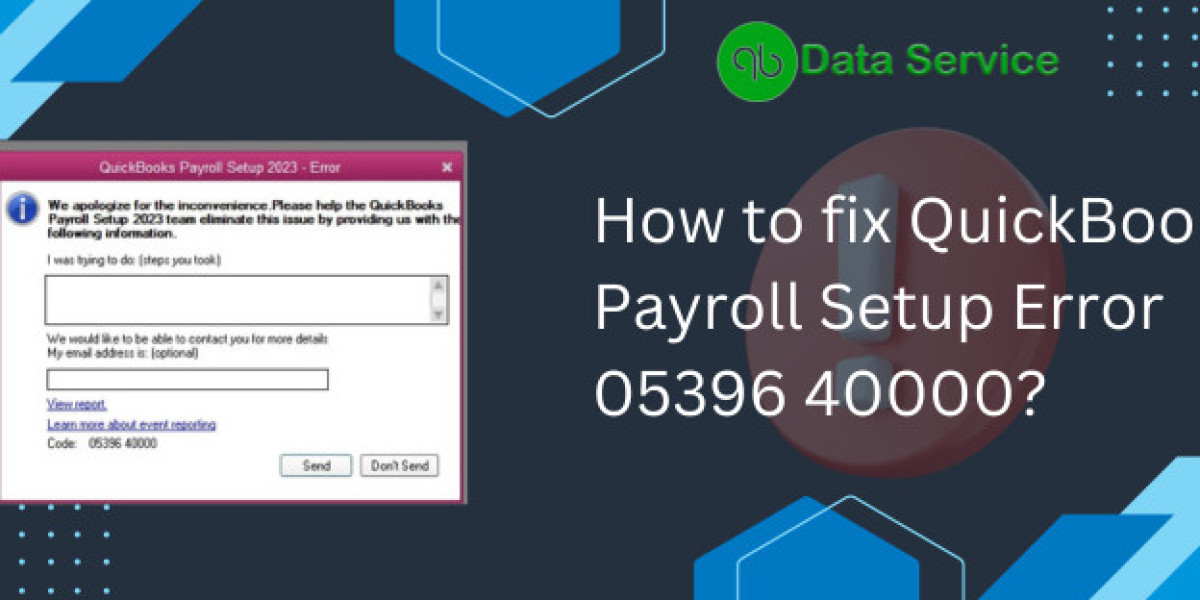

QuickBooks is an essential tool for businesses, particularly when it comes to managing payroll. However, like any software, it isn’t without its hiccups. One such issue that users may encounter is the Payroll Setup Error 05396 40000. This error can halt your payroll processes, leading to delays and frustration. If you've run into this problem, don’t worry. In this guide, we'll break down what causes this error, how to troubleshoot it, and what steps you can take to prevent it from happening again.

Find out more: QuickBooks Error 6000 77 – Latest Methods to fix it

Understanding QuickBooks Payroll Setup Error 05396 40000

QuickBooks Payroll Setup Error 05396 40000 usually occurs during the initial setup or update of payroll services within QuickBooks. The error typically arises due to misconfigurations in the payroll setup or problems with the company's data file. It can be triggered by various factors, including network issues, incorrect payroll settings, or even corrupted company files.

Common Causes of the Error

Incomplete or Incorrect Payroll Setup: If the payroll setup process is not completed correctly, this error is likely to occur. This can include missing or incorrect information in the company file or employee data.

Corrupted or Damaged Company Files: Sometimes, the company file itself might be corrupted or damaged, leading to issues during payroll setup or updates.

Network Issues: Problems with your network connection can cause interruptions in the payroll setup process, leading to this error.

Outdated QuickBooks Software: Running an outdated version of QuickBooks can cause compatibility issues with the payroll setup, triggering errors like 05396 40000.

Incorrect Payroll Subscription Information: If the payroll subscription information is incorrect or outdated, the payroll setup may not complete successfully, resulting in an error.

Step-by-Step Guide to Fix QuickBooks Payroll Setup Error 05396 40000

Now that we’ve covered the causes, let’s move on to how you can resolve this error. Follow these steps carefully to troubleshoot and fix the issue.

Step 1: Verify Your Payroll Subscription

One of the first steps in resolving this error is to verify that your payroll subscription is active and the information entered is correct.

- Open QuickBooks and navigate to the Employees menu.

- Select My Payroll Service and then click on Account/Billing Information.

- Log in using your Intuit account credentials.

- Verify that your payroll subscription is active and that all billing information is correct.

- If there are discrepancies, update your information accordingly and try running the payroll setup again.

Step 2: Update QuickBooks to the Latest Version

An outdated version of QuickBooks can often cause compatibility issues during the payroll setup process.

- Close all active QuickBooks windows.

- Go to the Help menu and click on Update QuickBooks Desktop.

- In the Update QuickBooks window, select the Update Now tab.

- Check the box for Reset Update to clear previous update downloads.

- Click on Get Updates to start the download.

- Once the updates are downloaded, restart QuickBooks and try setting up payroll again.

Step 3: Run the QuickBooks File Doctor Tool

If the error persists, it may be due to a corrupted or damaged company file. The QuickBooks File Doctor tool can help you identify and repair issues with your company file.

- Download the QuickBooks Tool Hub from Intuit’s official website.

- Install the Tool Hub on your system and run it.

- In the Tool Hub, select the Company File Issues tab.

- Click on Run QuickBooks File Doctor and choose the company file you want to repair.

- Follow the on-screen instructions to repair your company file.

- Once the repair is complete, try running the payroll setup again.

Check out more: A quick guide on QuickBooks Error 539

Step 4: Check and Repair Data Damage

If the File Doctor doesn’t resolve the issue, you can try verifying and rebuilding your data in QuickBooks.

- Go to the File menu and select Utilities.

- Choose Verify Data to check for data issues in your company file.

- If any issues are found, go back to the File menu, select Utilities, and choose Rebuild Data.

- Follow the prompts to repair the data.

- After rebuilding, attempt the payroll setup once more.

Step 5: Adjust Your Payroll Settings

If none of the above methods work, there may be an issue with your payroll settings.

- Go to the Employees menu and select Payroll Setup.

- Review all the information entered during the setup process, including employee details, tax information, and company data.

- Correct any discrepancies and ensure all required fields are filled out accurately.

- Save your changes and attempt to complete the payroll setup.

Preventing QuickBooks Payroll Setup Error 05396 40000

Prevention is always better than cure. To avoid encountering this error in the future, consider the following tips:

Regular Software Updates: Always keep your QuickBooks software updated to the latest version to avoid compatibility issues.

Backup Your Company File: Regularly back up your company file to prevent data loss and reduce the risk of file corruption.

Accurate Data Entry: Ensure that all payroll-related information is entered correctly during the setup process.

Regularly Verify Data: Use the Verify Data and Rebuild Data utilities in QuickBooks regularly to catch and fix potential issues before they become problematic.

Stable Network Connection: Ensure you have a stable and reliable network connection when setting up or updating payroll to avoid interruptions that could cause errors.

Read more: QuickBooks Error 6189 816 | Fix it with ProAdvisor’s

Conclusion

QuickBooks Payroll Setup Error 05396 40000 can be a frustrating hurdle, but with the right approach, it can be resolved quickly and efficiently. By following the steps outlined in this guide, you can troubleshoot the issue and get back to running your payroll without further delays. Remember, regular maintenance of your QuickBooks software and company files is key to preventing such errors in the future.

If you continue to experience issues or need additional assistance, don’t hesitate to contact our support team at +1-888-538-1314. We’re here to help you ensure that your payroll processes run smoothly.