The Information and Communication Technology (ICT) sector in Vietnam has become one of the most dynamic industries in the country, contributing significantly to its economic growth. Over the past decade, Vietnam has emerged as a global ICT hub, attracting investments from multinational corporations and nurturing a burgeoning startup ecosystem. This growth is driven by a combination of government support, a large, youthful population, and a competitive workforce.

In this article, we'll explore the key factors fueling the expansion of Vietnam's ICT market, its current trends, and the future opportunities that lie ahead.

Overview of Vietnam's ICT Market

Vietnam's ICT market has seen rapid development, particularly in software development, telecommunications, and IT services. The country's government has made the ICT sector a top priority, aiming to transform Vietnam into a digital economy by 2030. According to reports, the sector has been growing by over 9% annually and is expected to continue its upward trajectory in the coming years.

Key players in the global ICT industry, such as Intel, Samsung, and Microsoft, have already established significant operations in Vietnam. In 2022, the country exported over $130 billion worth of ICT-related products, highlighting its growing importance as a production hub in the global supply chain.

Key Drivers of Growth

Government Initiatives and Policies

The Vietnamese government has been instrumental in driving the ICT market's growth by introducing favorable policies and investing heavily in digital infrastructure. The "Make in Vietnam" initiative encourages local enterprises to develop their own digital products and services. The country’s national digital transformation plan aims to integrate digital technologies across all sectors by 2030.

In addition, the government has introduced tax incentives for ICT companies, lowered tariffs on imported technology, and eased regulatory barriers for foreign investors.

Youthful Workforce and Talent Pool

Vietnam has a young and highly skilled workforce, which is an attractive proposition for tech companies. With nearly 60% of the population under the age of 35, the country offers a large pool of tech-savvy professionals. Every year, thousands of graduates from engineering and IT programs join the workforce, bolstering the country’s potential to become a major player in the global ICT market.

Foreign Direct Investment (FDI)

The ICT sector in Vietnam has benefited significantly from foreign direct investment. Multinational companies have chosen Vietnam for its competitive labor costs, favorable business environment, and strategic location in Southeast Asia. For example, Samsung operates one of its largest smartphone manufacturing plants in Vietnam, contributing to a large portion of Vietnam's ICT exports.

In 2023, the total FDI inflow into Vietnam’s ICT sector surpassed $20 billion, a clear indication of foreign investors' confidence in the market.

Rising Demand for Digital Transformation

The COVID-19 pandemic accelerated digital adoption across all sectors in Vietnam. From e-commerce and fintech to healthcare and education, businesses have embraced digital solutions to remain competitive. This has led to an increased demand for cloud computing, data analytics, cybersecurity, and IT outsourcing services. As companies modernize and adopt advanced technologies like artificial intelligence (AI) and Internet of Things (IoT), the ICT market in Vietnam will continue to grow.

Key Market Segments

Telecommunications

Vietnam's telecom sector is one of the most developed in Southeast Asia. The country boasts over 150 million mobile phone subscriptions, with a strong demand for 4G services and the upcoming 5G rollout. Leading telecom providers such as Viettel, MobiFone, and VNPT are investing in expanding their networks to meet growing data usage and digital service demands.

Software Development and IT Outsourcing

Vietnam has become a preferred destination for software development and IT outsourcing due to its competitive costs and skilled workforce. The country ranks as one of the top outsourcing hubs globally, particularly for software development, web development, and mobile app development. Many companies from the US, Europe, and Japan outsource their IT services to Vietnam due to its expertise in these areas.

E-Commerce and Fintech

E-commerce and fintech have seen exponential growth in Vietnam. The country's e-commerce market was valued at $23 billion in 2022 and is expected to reach $39 billion by 2025. Companies such as Shopee, Tiki, and Lazada have capitalized on the growing demand for online shopping, while fintech startups are rapidly transforming the banking and payment landscape.

The government’s push towards a cashless society has also fueled growth in the fintech sector, with mobile payment services such as MoMo, ZaloPay, and VNPay gaining widespread adoption.

Future Outlook

The future of Vietnam’s ICT market is bright, with several factors positioning the country as a key player in the global digital economy. As the government continues to invest in smart cities, digital infrastructure, and high-tech zones, Vietnam is likely to attract even more foreign investments in the ICT sector.

Moreover, Vietnam’s talent pool will continue to expand as more universities and vocational training programs emphasize ICT skills, positioning the country as a leader in software development and IT services. The rising demand for digital transformation across industries, along with the growth of emerging technologies such as AI, IoT, and blockchain, will further drive the ICT sector’s growth.

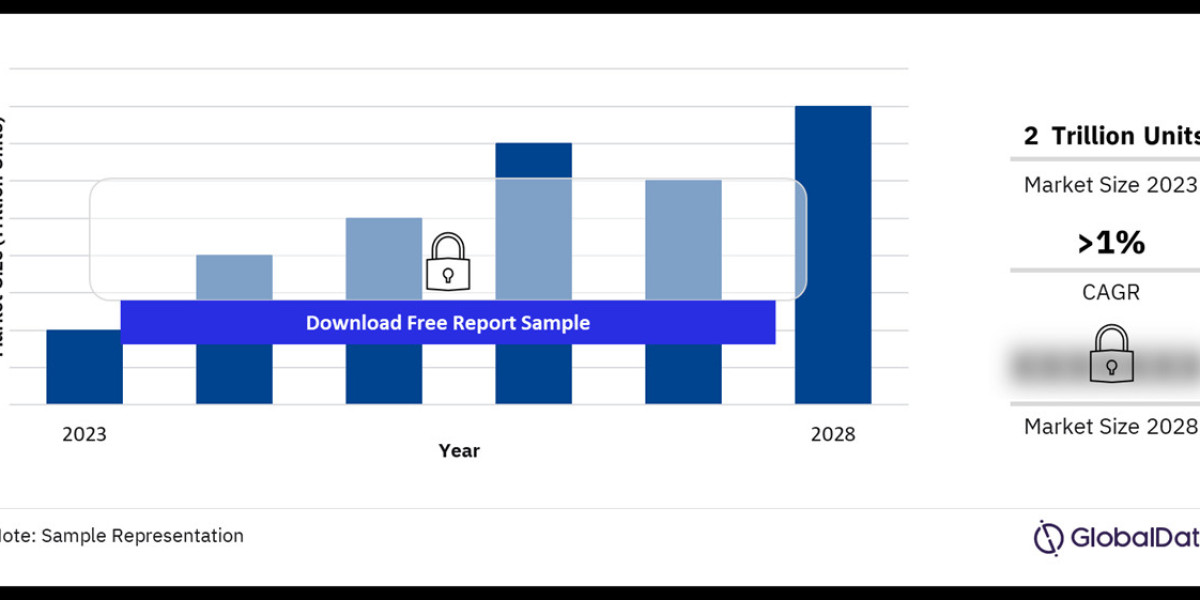

Buy the Full Report for More Insights into the Vietnam ICT Market Forecast