The Mexico power market is evolving rapidly, driven by energy reform policies, growing demand, and the need for sustainable energy sources. As the second-largest economy in Latin America, Mexico is working to modernize its electricity sector, enhance energy efficiency, and meet the growing demand for power. This article provides an in-depth look at the current state of Mexico’s power market, key players, trends, challenges, and future opportunities for growth.

Market Overview

Mexico's power market has undergone significant changes since the 2013 energy reforms, which aimed to open up the electricity sector to private investment and competition. The reforms were designed to break the monopoly of the state-owned Comisión Federal de Electricidad (CFE) and encourage participation from private companies. This shift has led to increased competition and the diversification of energy sources, with a focus on renewables.

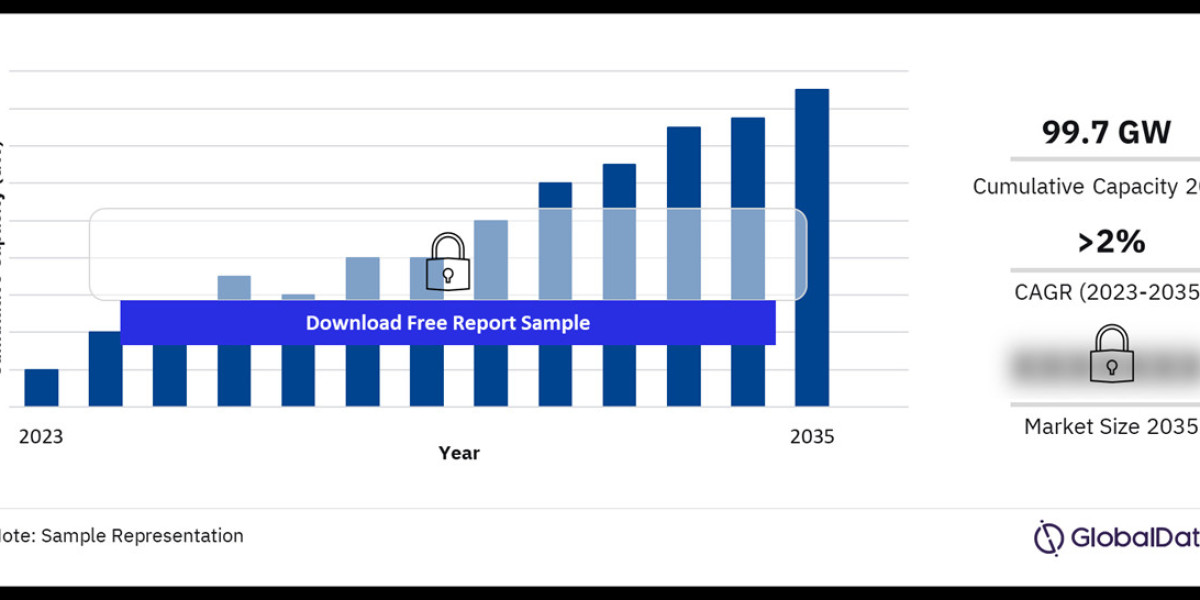

Mexico's installed power capacity is diverse, with a mix of fossil fuels, renewables, and nuclear power. As of 2023, approximately 60% of the country's electricity comes from natural gas, while 30% is generated from renewable sources, including wind, solar, and hydropower. Mexico is also a regional leader in renewable energy, especially in wind and solar power, and has ambitious goals to increase renewable energy capacity to 35% by 2024.

Key Trends in the Mexico Power Market

Shift Towards Renewable Energy: Mexico’s geographic position offers vast potential for renewable energy projects. The country has some of the best solar and wind resources globally, especially in regions like Baja California and Oaxaca. Investment in renewable energy has surged in recent years, with solar energy production increasing by 30% in 2022.

Private Sector Participation: Since the 2013 reforms, private companies have played an increasing role in Mexico's power market. These companies have been instrumental in driving innovation, increasing efficiency, and expanding renewable energy projects. Foreign investments have also poured into Mexico, particularly from U.S. and European energy companies seeking opportunities in the growing renewable energy sector.

Government Policies and Energy Reforms: The López Obrador administration has prioritized strengthening CFE’s role in the market, which has raised concerns about the future of private investment in the sector. Despite this, Mexico remains committed to meeting its climate goals, including reducing carbon emissions and increasing the share of renewable energy in its energy mix.

Growing Demand for Power: Mexico’s energy consumption is on the rise, driven by population growth, industrialization, and urbanization. The demand for electricity is expected to increase by an average of 4% annually through 2030. To meet this growing demand, significant investment in new power generation, transmission, and distribution infrastructure is required.

Decentralization and Grid Modernization: One of the key challenges facing Mexico’s power market is the need for modernization of the grid infrastructure. Mexico’s electricity grid has been centralized for decades, but decentralization efforts are underway to make the system more efficient and better able to handle renewable energy sources. Smart grid technology, energy storage systems, and microgrids are being developed to improve reliability and energy distribution.

Challenges Facing the Mexico Power Market

Regulatory Uncertainty: Regulatory uncertainty remains a major challenge for private investors. While energy reforms opened the market to competition, recent policy shifts under the López Obrador government have increased concerns about the future of these reforms. The government's emphasis on strengthening CFE’s control over the market has led to delays in private investment and project development.

Infrastructure Development: Mexico’s aging energy infrastructure is another key challenge. The country needs substantial investment in transmission and distribution networks to accommodate the growth in renewable energy projects and meet the rising demand for electricity. Without adequate infrastructure, the benefits of increased power generation from renewables could be limited.

Energy Prices: Energy pricing in Mexico is highly regulated, which can limit the profitability of private sector projects. Additionally, Mexico’s reliance on natural gas imports from the U.S. exposes the country to price fluctuations, which can affect electricity costs for both consumers and businesses.

Opportunities in the Mexico Power Market

Expansion of Renewable Energy: Mexico's renewable energy potential is vast, and continued investment in solar and wind projects will be crucial for meeting the country’s energy goals. The development of offshore wind farms, in particular, presents a significant opportunity for both local and international companies.

Energy Efficiency and Smart Technologies: As Mexico seeks to modernize its energy infrastructure, there is significant potential for companies specializing in smart grid technologies, energy storage, and energy efficiency solutions. Investments in these areas will be essential to managing the country’s growing demand for electricity.

Cross-Border Energy Trade: Mexico’s proximity to the United States creates opportunities for cross-border energy trade. Mexico is already a significant importer of natural gas from the U.S., but there is potential for increased collaboration on renewable energy projects and transmission infrastructure. Strengthening these cross-border partnerships could benefit both countries’ energy markets.

Investment in Energy Infrastructure: The modernization of Mexico's energy infrastructure will require substantial investment, particularly in transmission and distribution networks. Private companies and foreign investors can play a key role in this development, creating opportunities for those with expertise in infrastructure projects.

Buy the Full Report for More Insights into the Mexico Power Market Forecast