The Saudi Arabia region is witnessing a significant shift in the landscape of cancer care, driven by the increasing demand for affordable and accessible treatment options. Within this context, the generic oncology drug market in SAUDI ARABIA is emerging as a key player, offering therapeutically equivalent alternatives to branded medications at lower costs.

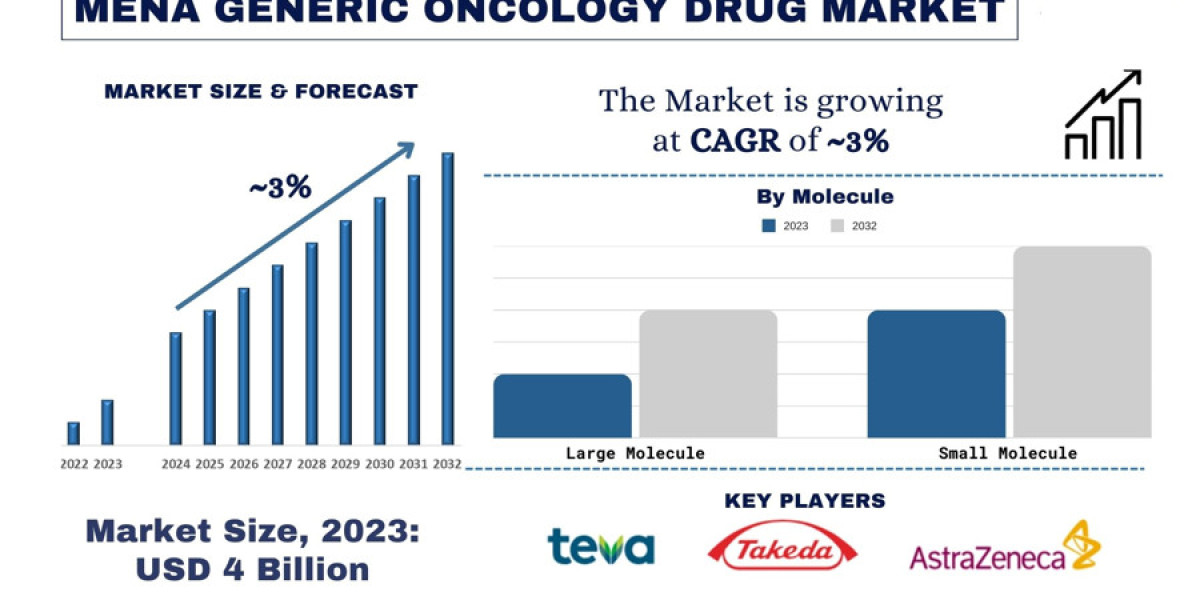

According to the UnivDatos Market Insights Analysis, the growing awareness of generic medicines in the region will drive the scenario of Generic Oncology Drugs and as per their “MENA Generic Oncology Drug Market” report, the Saudi Arabia market was valued at USD ~4 billion in 2022, growing at a CAGR of 3% during the forecast period from 2024 - 2032.

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/get-a-free-sample-form-php/?product_id=59037

Market Dynamics:

The Saudi Arabia generic oncology drug market is experiencing robust growth, propelled by several factors. Firstly, the rising incidence of cancer in the region, attributed to factors such as aging populations, lifestyle changes, and environmental factors, has created a growing demand for oncology medications. Secondly, the high cost of branded oncology drugs has prompted patients and healthcare providers to seek more affordable alternatives. Generic oncology drugs offer cost-effective treatment options without compromising on quality or efficacy, making them increasingly attractive in the Saudi Arabia region.

Furthermore, the Saudi Arabia region's healthcare landscape is undergoing significant transformation, with governments investing in healthcare infrastructure and implementing policies to enhance access to essential medicines. These efforts, coupled with the expansion of insurance coverage and the proliferation of generic drug manufacturers, are driving market growth. Additionally, collaborations between multinational pharmaceutical companies and local players are facilitating technology transfer and knowledge sharing, further boosting the development and distribution of generic oncology drugs in Saudi Arabia.

Government Regulations:

Government regulations play a crucial role in shaping the generic oncology drug market in Saudi Arabia, ensuring the quality, safety, and efficacy of pharmaceutical products. Regulatory agencies in the region, such as the Saudi Food and Drug Authority (SFDA), the UAE Ministry of Health and Prevention (MOHAP), and the Egyptian Drug Authority (EDA), enforce stringent standards for the approval and marketing of generic medications.

One of the key regulations governing the generic oncology drug market in Saudi Arabia is the requirement for bioequivalence studies. Generic drug manufacturers must demonstrate that their products are bioequivalent to the corresponding branded medications through comparative pharmacokinetic studies. These studies assess the rate and extent of drug absorption, ensuring that generic drugs achieve similar blood concentration profiles as their branded counterparts. By adhering to bioequivalence requirements, generic oncology drug manufacturers in Saudi Arabia can obtain regulatory approval and enter the market with confidence.

Moreover, regulatory agencies in Saudi Arabia have implemented measures to combat counterfeit drugs and ensure the integrity of the pharmaceutical supply chain. Serialization and track-and-trace systems are increasingly being adopted to monitor the movement of medications from production facilities to pharmacies, reducing the risk of counterfeit products entering the market. Additionally, pharmacovigilance programs are in place to monitor and report adverse drug reactions, safeguarding patient safety and public health.

Related Reports-

Pulmonary Arterial Hypertension Market: Current Analysis and Forecast (2024-2032)

Polymer-Based Prefilled Syringe Market: Current Analysis and Forecast (2024-2032)

Prospects:

The Saudi Arabia generic oncology drug market is poised for continued growth and innovation. With the introduction of biosimilars and the expansion of digital health solutions, new opportunities are emerging to enhance access to cancer care in the region. Biosimilars offer cost-effective alternatives to biologic oncology drugs, providing patients with more treatment options and driving competition in the market. Digital health solutions, including telemedicine platforms and e-prescribing systems, are improving healthcare delivery and patient engagement, further supporting the adoption of generic oncology medications.

Conclusion

In conclusion, the generic oncology drug market in Saudi Arabia is experiencing dynamic growth, driven by increasing demand, government regulations, and technological advancements. By providing affordable and accessible treatment options, generic oncology drugs are playing a critical role in expanding cancer care in the region. Moving forward, collaboration between industry stakeholders and regulatory agencies will be essential to ensure the continued success and sustainability of the Saudi Arabia generic oncology drug market, ultimately benefiting patients and healthcare systems alike.