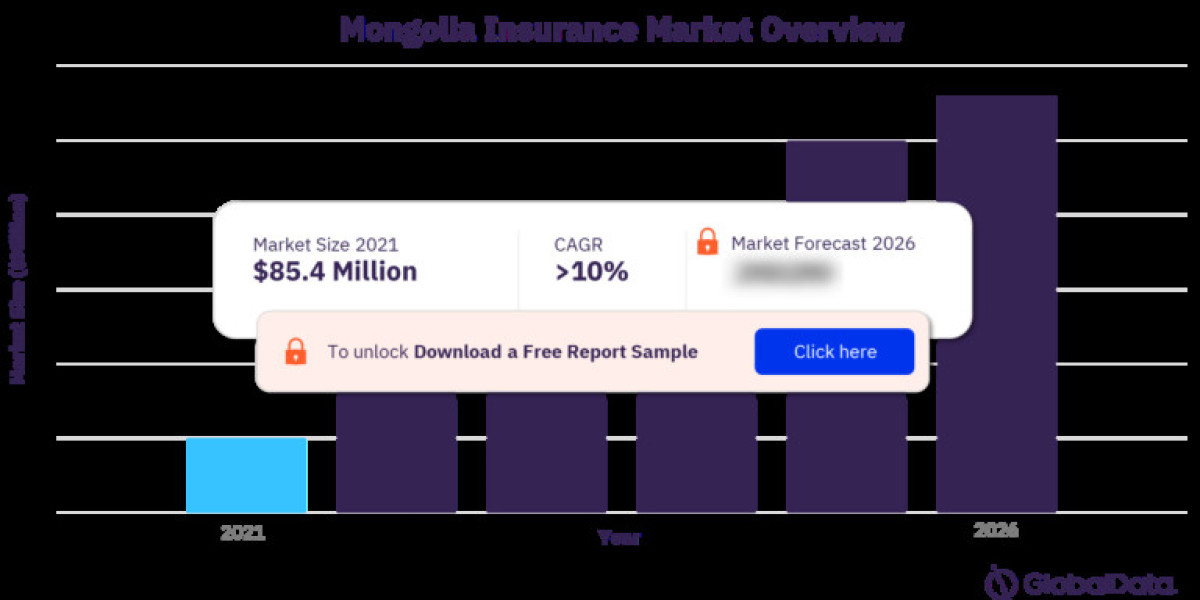

Mongolia's insurance market, while nascent compared to regional giants, boasts a dynamic landscape with a mix of domestic leaders and a growing international presence. This analysis delves into the key players shaping the Mongolian insurance landscape, offering a comparative analysis of their strengths, weaknesses, opportunities, and threats (SWOT analysis).

To gain more information on the Mongolia insurance market forecast, download a free report sample

Domestic Dominance: Established Players

Mongol Insurance LLC:

- Strengths:

- Market leader with a long-standing reputation and extensive branch network.

- Diversified product portfolio covering life, property & casualty, and health insurance.

- Weaknesses:

- Potential for bureaucratic processes due to its size and established nature.

- May require adaptation to keep pace with emerging technological trends.

- Opportunities:

- Leverage existing brand recognition to expand market share in new segments like microinsurance.

- Implement digital solutions to enhance customer experience and accessibility.

- Threats:

- Increased competition from agile domestic players and international entrants.

- Potential economic downturns impacting disposable income and insurance spending.

- Strengths:

Bodi Insurance LLC:

- Strengths:

- Strong focus on customer service and building trust with policyholders.

- Innovative product offerings, particularly in the health insurance segment.

- Weaknesses:

- Smaller market share compared to Mongol Insurance.

- Limited branch network compared to the market leader.

- Opportunities:

- Partner with financial institutions and other businesses to expand distribution channels.

- Utilize technology to reach a wider customer base in remote locations.

- Threats:

- Difficulty competing with Mongol Insurance's brand recognition and established client base.

- Regulatory changes that could impact its product offerings.

- Strengths:

Emerging Players: Innovation and Niche Focus

ARD Insurance LLC:

- Strengths:

- Strong focus on motor vehicle insurance, a key segment in the Mongolian market.

- Competitive pricing strategies to attract cost-conscious consumers.

- Weaknesses:

- Limited product portfolio compared to larger players.

- Less established brand recognition compared to domestic leaders.

- Opportunities:

- Expand product offerings to cater to a wider range of customer needs.

- Leverage digital marketing to build brand awareness and reach new customer segments.

- Threats:

- Price wars with other insurers impacting profitability.

- Difficulty competing with established players for talent and resources.

- Strengths:

MIG Insurance LLC & Tenger Insurance LLC:

- Strengths:

- Emerging players with a focus on specific market niches, like health or microinsurance.

- Ability to be more agile and adapt to changing market trends.

- Weaknesses:

- Limited brand awareness and market share compared to established players.

- May lack the resources to compete on a larger scale.

- Opportunities:

- Partner with established players for distribution or resources.

- Focus on niche markets with high growth potential.

- Threats:

- Difficulty attracting customers away from established brands.

- Difficulty securing funding or investment for expansion.

- Strengths:

International Presence: A Limited Footing

While there is a limited international presence in the Mongolian insurance market, some multinational companies are starting to explore opportunities. Here's a general overview of their potential impact:

- Strengths:

- Access to international best practices and expertise.

- Strong financial backing to invest in infrastructure and technology.

- Weaknesses:

- Lack of local market knowledge and brand recognition.

- Regulatory hurdles and potential challenges in navigating the Mongolian business environment.

- Opportunities:

- Partner with domestic players to leverage their distribution channels and expertise.

- Cater to the growing demand for specialized insurance products not yet offered by domestic players.

- Threats:

- Difficulty competing with established domestic brands on price and familiarity.

- Unforeseen economic or political instability impacting foreign investment.

Conclusion:

The Mongolian insurance market presents a dynamic landscape with established players like Mongol Insurance and Bodi Insurance holding a dominant position. However, emerging domestic players and potential international entrants are poised to challenge the status quo. The key to success in this market will hinge on factors like product innovation, efficient distribution channels, a strong focus on customer service, and the ability to leverage technology for enhanced accessibility. As the Mongolian insurance market matures, a vibrant competition between domestic players and international entrants is likely to unfold, ultimately benefiting consumers through a wider range of insurance products and competitive pricing.