Life insurance might not be the most exciting topic, but it's undeniably one of the most crucial financial decisions you can make in the UK. It provides a vital safety net for your loved ones in the unfortunate event of your passing. This comprehensive guide delves into everything you need to understand about the UK life insurance market, empowering you to make informed choices for your family's future.

Why Do You Need Life Insurance in the UK?

According to [SISTRIX], around 35% of the UK adult population has life insurance, highlighting its importance. Here's why it's a wise investment:

Financial Security for Dependents: Life insurance provides a tax-free lump sum payout to your beneficiaries upon your death. This financial cushion can help them cover essential expenses like mortgage payments, living costs, and education for children.

Peace of Mind: Knowing your loved ones are financially protected brings immense peace of mind. You can focus on living life to the fullest without worrying about the future financial burden you might leave behind.

Debt Repayment: Life insurance can be used to pay off outstanding debts like mortgages, credit cards, or personal loans. This ensures your family inherits a debt-free future.

Income Replacement: Some life insurance policies offer income protection benefits. These can provide a monthly income stream to your family, replacing the lost income you contributed.

Navigating the UK Life Insurance Market

The UK life insurance market offers a diverse range of policies catering to various needs and budgets. Here's a breakdown of the main types:

Term Life Insurance: This is the most common and affordable type. It provides coverage for a specific period (term) like 20 or 30 years. If you die within the term, your beneficiaries receive a payout. However, if you outlive the term, no payout is made.

Whole Life Insurance: This policy offers lifelong coverage. It builds cash value alongside the death benefit. The cash value accumulates over time and can be accessed through loans or withdrawals during your lifetime.

Universal Life Insurance: Similar to whole life, it offers both a death benefit and cash value accumulation. However, you have more flexibility with premium payments and investment options.

Critical Illness Cover: This policy provides a payout if you are diagnosed with a critical illness like cancer, heart attack, or stroke. The payout can be used to cover medical bills, lost income, or other expenses.

Income Protection Insurance: This policy replaces a portion of your income if you become disabled due to illness or accident.

Factors to Consider When Choosing a Life Insurance Policy

Choosing the right life insurance policy requires careful consideration. Here are some key factors to keep in mind:

Your Needs and Budget: Assess your financial obligations like dependents, mortgage, and desired coverage amount. Choose a policy with a death benefit that can adequately meet your family's needs and ensure you can afford the premiums comfortably.

Term Length: Consider the period for which your family would need financial protection. For instance, if you have young children, a longer term might be suitable.

Policy Type: Evaluate your needs and risk tolerance. Term life offers affordability, while whole or universal life provides long-term coverage and cash value accumulation. Critical illness or income protection can offer additional security.

Medical History and Lifestyle: Your health and lifestyle habits affect your premium rates. Pre-existing medical conditions or risky hobbies might increase costs.

Renewal Options: Term life policies need renewal at the end of the term, potentially at a higher premium due to your age and health. Check if the policy offers guaranteed renewal options or convertibility to whole life.

Exclusions and Riders: Understand any exclusions in the policy, such as death by suicide or dangerous activities. Consider adding riders that offer additional benefits like accidental death cover or waiver of premium if disabled.

Finding the Best Life Insurance Deal in the UK

With numerous providers offering life insurance in the UK, comparing options is crucial to find the best deal. Here are some tips:

Get Quotes from Multiple Providers: Don't settle for the first offer you receive. Obtain quotes from several reputable insurers to compare premiums and coverage details.

Utilise Comparison Websites: Online life insurance comparison websites allow you to compare quotes from various providers in one place. However, ensure they compare like-for-like policies and consider their own biases.

Seek Independent Financial Advice: An independent financial advisor can assess your needs and recommend suitable life insurance options based on your circumstances. They can also help negotiate premiums with providers.

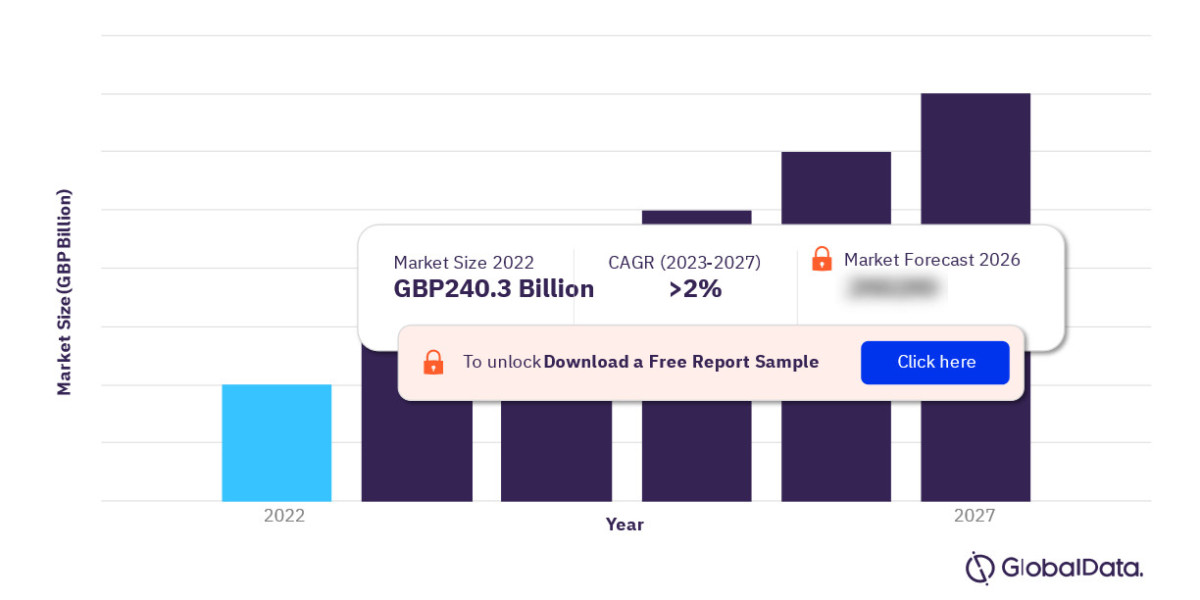

To gain more information about the UK life insurance market forecast, download a free report sample