The COVID-19 pandemic significantly impacted the New Zealand life insurance market, posing both challenges and unexpected opportunities.

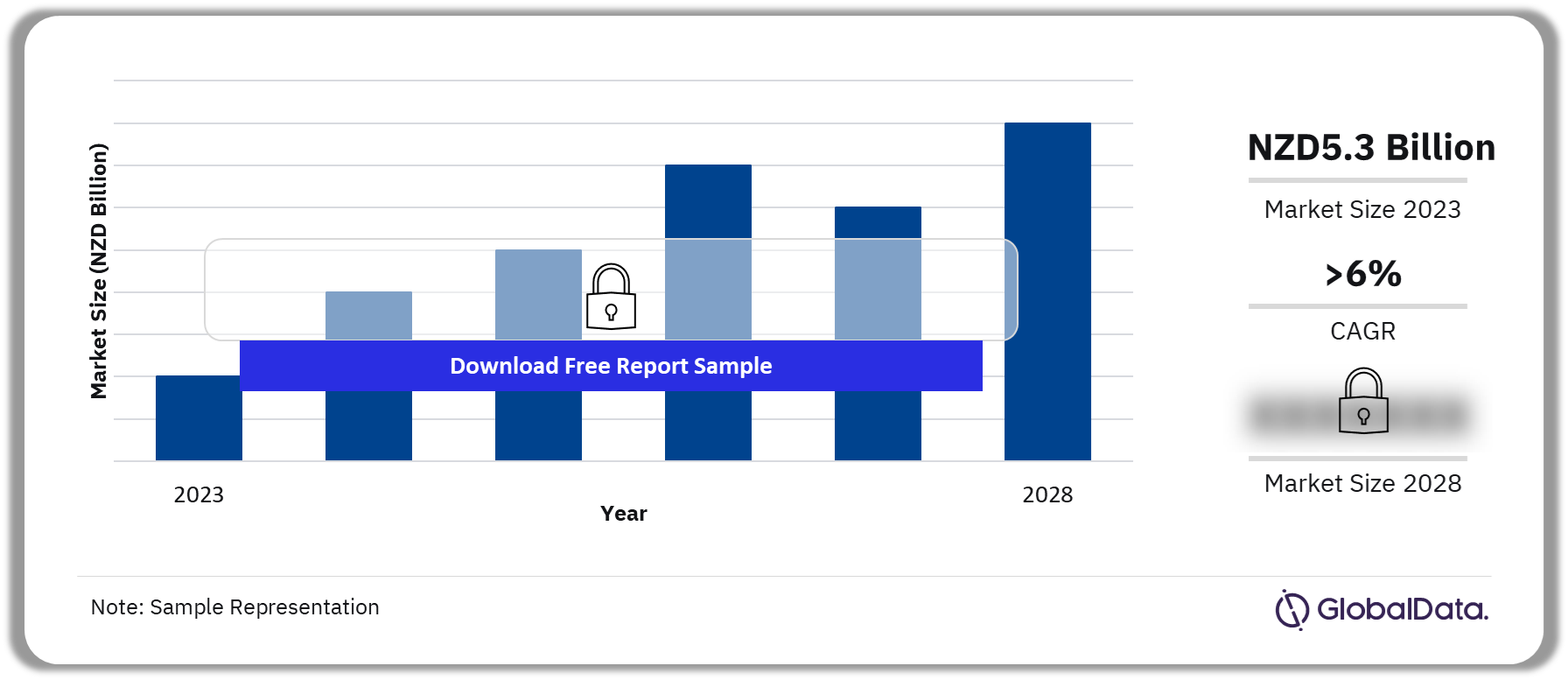

Buy the Full Report to Gain More Information about the New Zealand Life Insurance Market Forecast

Let's delve into the key effects on this crucial financial security sector.

Increased Mortality Claims:

- While New Zealand's strict lockdown measures and strong healthcare system curbed COVID-related deaths, there was a noticeable increase in life insurance claims. This put pressure on insurers' profitability and highlighted the importance of accurate risk assessment practices.

Shifting Consumer Behavior:

- The pandemic triggered a heightened awareness of mortality risk and financial vulnerability. This led to:

- Increased Demand for Income Protection: The uncertainty surrounding employment and income during lockdowns fueled a rise in demand for income protection products.

- Focus on Affordability: Economic concerns led consumers to prioritize affordability when choosing life insurance coverage.

Operational Challenges:

- Lockdowns and social distancing measures caused disruptions in traditional sales channels like face-to-face meetings with financial advisors. This necessitated:

- Shift to Online Platforms: Life insurance companies accelerated the adoption of online platforms for application processing and customer interaction.

- Remote Work Adaptation: The industry had to adapt to remote work arrangements for claim processing and customer service, leading to potential efficiency gains in the long run.

Regulatory Considerations:

- The Financial Markets Authority (FMA) introduced temporary relief measures for life insurance premium payments during the pandemic. This helped policyholders facing financial hardship maintain coverage.

Unforeseen Opportunities:

- The pandemic inadvertently presented opportunities for the life insurance market:

- Focus on Mental Health: The increased focus on mental health during the pandemic may lead to a wider range of life insurance products incorporating mental health coverage, catering to a growing need.

- Digital Transformation: The accelerated adoption of digital tools for sales and service delivery can pave the way for a more efficient and customer-centric industry in the future.

Looking Ahead:

- The long-term impact of COVID-19 on the life insurance market is still unfolding. However, the pandemic has spurred positive changes:

- Greater Emphasis on Risk Assessment: Life insurance companies may place a stronger emphasis on risk assessment factors like pre-existing health conditions to ensure accurate pricing and coverage.

- Customer-Centric Innovation: The industry is expected to develop more innovative and flexible life insurance products addressing the evolving needs of policyholders.

Conclusion:

The COVID-19 pandemic undeniably challenged the New Zealand life insurance market. However, the industry's adaptability and willingness to embrace digital transformation hold the potential for a more resilient and customer-focused future. By addressing concerns about affordability and incorporating mental health coverage, the life insurance market can play a crucial role in providing financial security and peace of mind to New Zealanders in the post-pandemic era.