As the demand for clean energy solutions surges, the lithium mining market is experiencing phenomenal growth. This article delves into the intricacies of this market, exploring its current landscape, future prospects, and the key factors shaping its trajectory.

Market Size and Growth Projections:

Market research estimates vary slightly, but all point towards a significant upward trend. Reports suggest the global lithium mining market was valued at around $3.9 billion in 2023 [1, 2, 3]. While some predict a steady growth with a CAGR (Compound Annual Growth Rate) of around 6.4% reaching $6.4-$6.9 billion by 2032 [2, 3], others anticipate a more aggressive expansion, reaching nearly $1.4 billion by 2026 at a CAGR of 20.8% [4]. This disparity highlights the dynamic nature of the market, heavily influenced by the ever-evolving EV industry and government policies towards clean energy adoption.

Market Segmentation:

The lithium mining market can be segmented based on two primary factors: source and product type.

Source:

- Brine: Lithium-rich brines are found in underground salt lakes or salars. This method involves pumping the brine solution to the surface, where it undergoes a series of evaporation and processing steps to extract lithium. Major brine operations exist in South America's Lithium Triangle (Chile, Argentina, Bolivia).

- Hard Rock: Lithium is also found in certain rock formations. Mining involves extracting the ore, crushing it, and employing chemical processes to separate the lithium. Australia is a dominant player in hard rock lithium mining.

Product Type:

- Lithium Carbonate (Li2CO3): The most common form of lithium used in batteries and ceramics.

- Lithium Hydroxide (LiOH): Gaining traction due to its higher efficiency in high-performance batteries for EVs.

Currently, hard rock mining dominates the market due to the wider availability of these resources. However, advancements in brine extraction technology and the vast potential of brine reserves, particularly in South America, could lead to a shift in the coming years.

Key Drivers of the Market:

- Electric Vehicle Boom: The primary driver is the surging demand for EVs. Lithium-ion batteries are the heart of EVs, and as governments push for cleaner transportation solutions and consumers embrace eco-friendly options, the demand for lithium is expected to rise exponentially.

- Consumer Electronics and Energy Storage: Lithium-ion batteries power a wide range of electronics like laptops and smartphones. Additionally, lithium batteries are crucial for storing renewable energy from sources like solar and wind, fostering grid stability and facilitating the transition to clean energy.

- Government Policies: Many governments are implementing policies promoting EV adoption and renewable energy integration. These policies include subsidies for EV purchases, investments in charging infrastructure, and regulations mandating stricter emission standards. Such initiatives directly influence lithium demand.

Challenges and Concerns:

- Environmental Impact: Lithium mining can have a detrimental impact on the environment. Brine extraction can lead to water scarcity and disrupt fragile ecosystems. Hard rock mining can cause soil erosion, air pollution, and require vast amounts of water for processing. Sustainable mining practices and stricter regulations are crucial to mitigate these issues.

- Geopolitical Landscape: A significant portion of global lithium reserves are concentrated in a few countries, raising concerns about supply chain security and potential price manipulation. Diversifying exploration efforts and fostering international cooperation are essential to ensure a stable supply.

- Ethical Labor Practices: Unethical labor practices and child labor concerns have been highlighted in some lithium-producing countries. Ensuring fair labor conditions and responsible sourcing are critical aspects of a sustainable lithium mining industry.

Major Players and Future Trends:

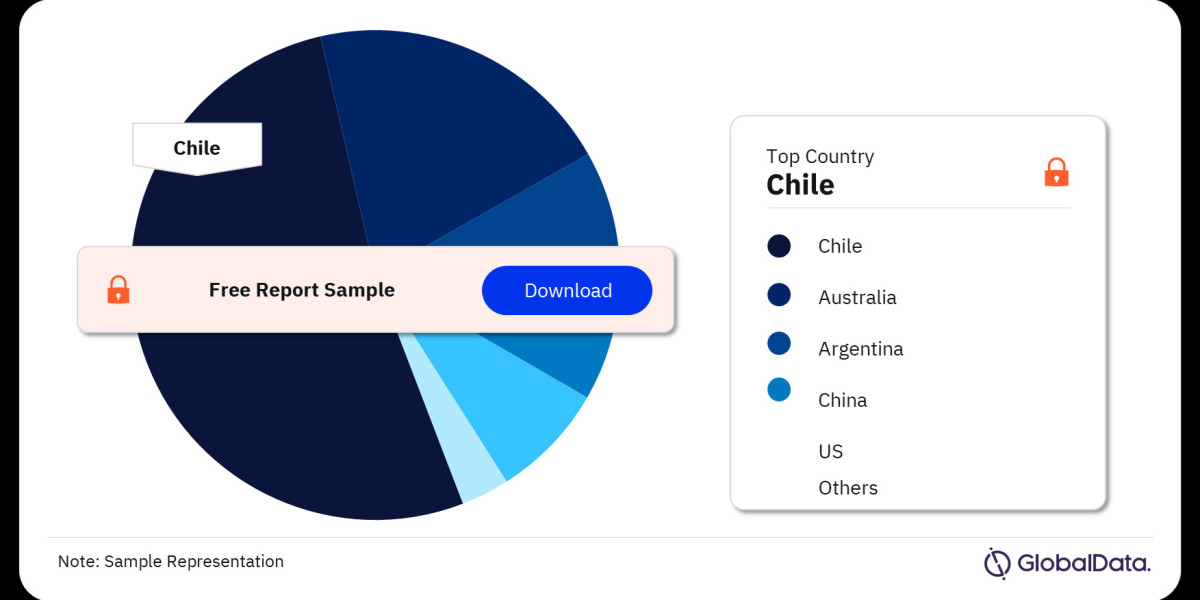

The lithium mining market is a complex landscape with a mix of established players and emerging companies. Some of the leading players include SQM (Chile), Albemarle Corporation (US), FMC Lithium (US), Tianqi Lithium (China), and Pilbara Minerals (Australia).

Looking ahead, several trends are expected to shape the market:

- Technological Advancements: Innovations in extraction and processing technologies are crucial for both economic and environmental sustainability. Techniques like direct lithium extraction from brines hold immense promise for reducing water consumption and processing time.

- Exploration and Resource Diversification: The focus will likely shift towards exploring new lithium resources and diversifying geographical supply chains to lessen dependence on a few dominant players.

Buy the Full Report for More Insights into the Global Lithium Market Forecast, Download A Free Report Sample