Algorithmic Trading Market was valued at USD 14.58 billion in 2023 and is expected to reach USD 25.68 billion by 2031, rising at a CAGR of 7.33% between 2024 and 2031.The report includes key business insights, demand analysis, pricing analysis, and competitive landscapes.This empowers our clients to seize opportunities, navigate risks, optimize their strategies effectively, and build the businesses of tomorrow.

Competitive Landscapes:-

The algorithmic trading market is highly fragmented, with key players such as QuantConnect, Symphony, TATA Consultancy Services, Citadel, Jane Street, and Tradetron driving innovation through acquisitions, partnerships, and new product launches. For instance, MarketAxess Holdings Inc.'s acquisition of Pragma in October 2023 highlights the strategic moves companies are making to enhance their service offerings and market reach.

Get More Info with TOC @ https://www.kingsresearch.com/algorithmic-trading-market-660

Key Players in Algorithmic Trading Market:-

- QuantConnect

- Symphony

- TATA Consultancy Services Limited

- Citadel Enterprise Americas LLC

- Jane Street Group, LLC

- Tradetron

- IMC

- Reuters

- XTX Markets Limited

- Wyden

Trends:-

Deployment Mode: The cloud segment dominated the market with a 62.96% share in 2023. The scalability, cost-efficiency, and accessibility of cloud-based platforms enable traders to deploy sophisticated algorithms without extensive infrastructure investments. This trend is expected to continue, facilitating real-time collaboration and data sharing, and driving greater efficiency and innovation

Dynamics:-

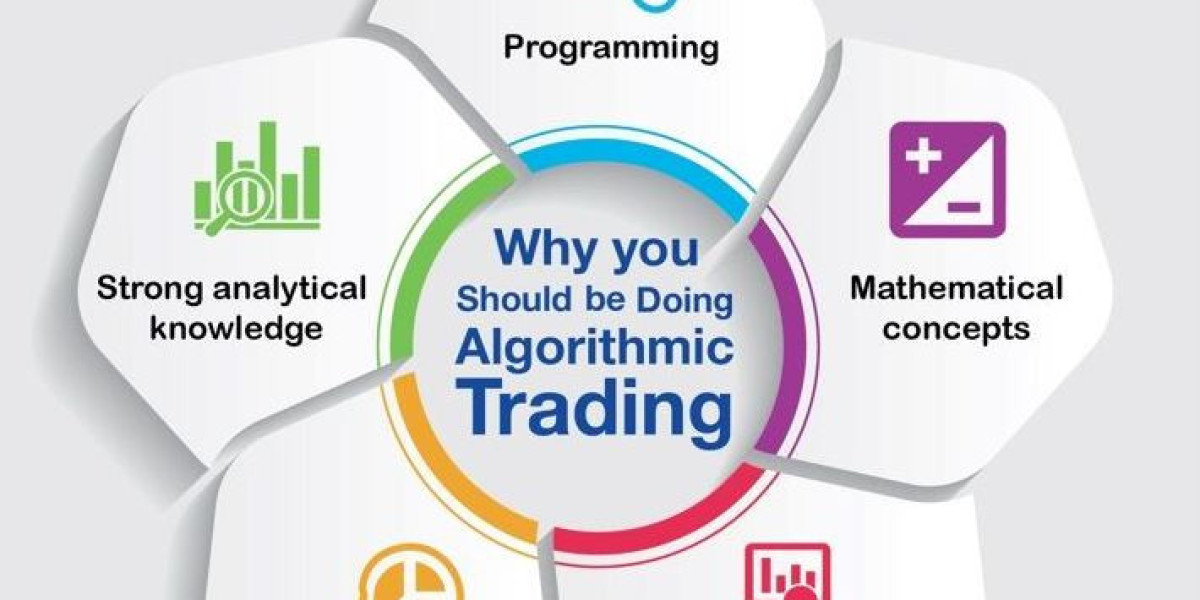

Technological Advancements: The integration of AI, machine learning, and big data analytics is revolutionizing algorithmic trading. These technologies enable the development of more sophisticated and efficient trading strategies, improving accuracy and execution speed.

Regulatory Landscape: Regulations aimed at ensuring market transparency and reducing systemic risks are driving the adoption of algorithmic trading. Compliance requirements are prompting firms to invest in advanced trading systems that can handle regulatory complexities.

ESG Considerations: The incorporation of ESG factors into trading algorithms is creating new opportunities for market participants. By integrating ESG criteria, traders can align their strategies with sustainable investment principles, attracting a growing segment of environmentally and socially conscious investors.

Customized Solutions: The demand for personalized investment strategies is leading to the development of bespoke algorithmic solutions. By tailoring algorithms to individual client needs, firms can enhance performance and build stronger client relationships, positioning themselves competitively in the market.

Regions:-

Asia-Pacific: This region is anticipated to record the fastest growth, with a CAGR of 8.59% from 2024 to 2031. The rapid expansion of financial markets and increasing investor participation are propelling the demand for algorithmic trading solutions. Significant investments in technological infrastructure and the high penetration of mobile phones are additional factors driving growth. By 2031, the market value in Asia-Pacific is expected to reach USD 6.29 billion

Algorithmic Trading Market is Segmented as:

By Deployment Mode:-

- Cloud

- On-Premises

By Trading Type:-

- Stock Market

- Foreign Exchange

- Exchange-Traded Fund

- Bonds

- Cryptocurrencies

- Others

By End User:-

- Short-Term

- Long-Term

- Retail Investor

- Institutional Investor